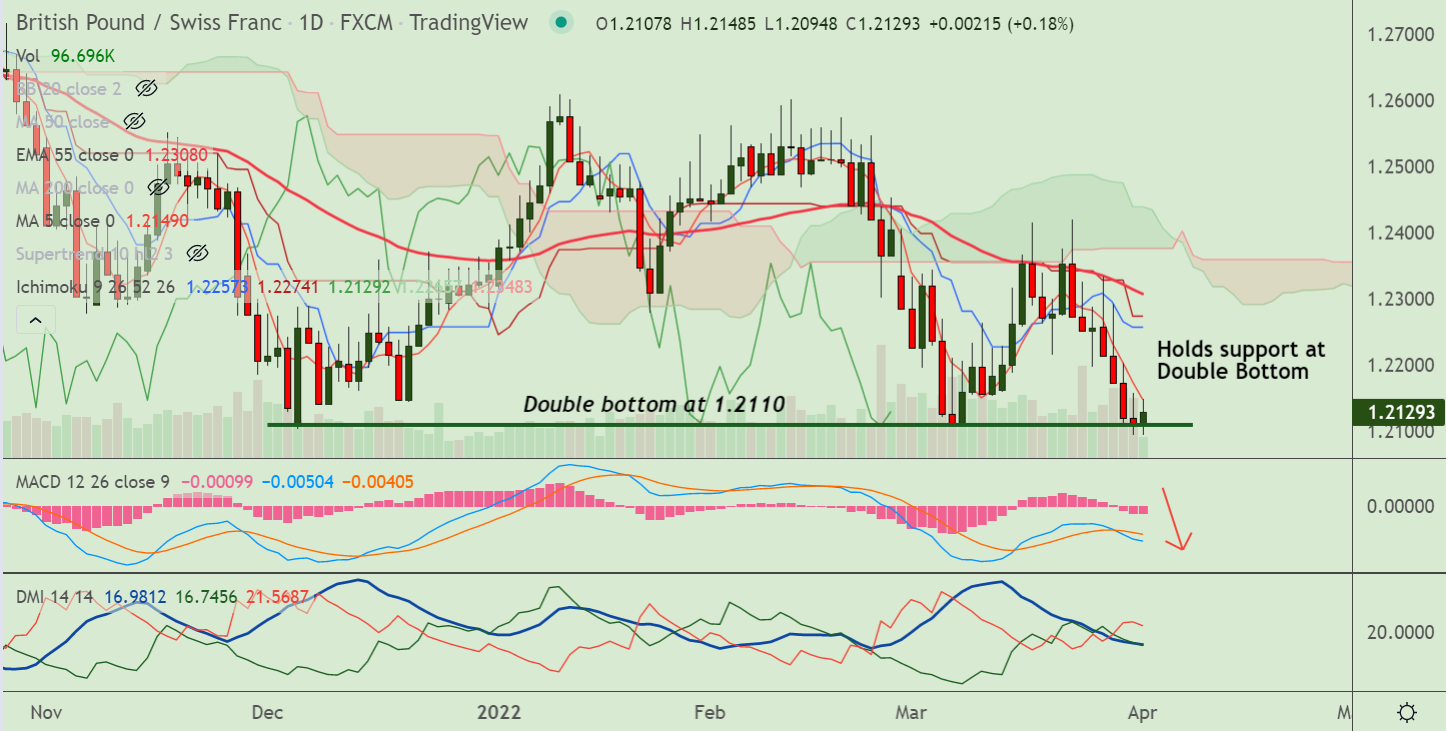

Chart - Courtesy Trading View

GBP/CHF was trading 0.19% higher on the day at 1.2130 at around 10:00 GMT.

The pair has snapped four days of downside and edged higher, bias remains bearish.

Price action has bounced off major support at 1.2110 (Double Bottom), break below will plummet prices.

Major moving averages are trending lower, price action is below major moving averages, 5-DMA caps upside in the pair.

MACD confirms bearish crossover on signal line, ADX supports weakness. Momentum is bearish and volatility is high.

Bearish 5-DMA crossover on 20-DMA adds to the downside bias, Chikou span is biased lower.

Support levels - 1.2110 (Double Bottom), 1.2071 (Lower BB)

Resistance levels - 1.2150 (5-DMA), 1.2218 (20-DMA)

Summary: GBP/CHF recovery lacks traction, the pair is poised for further downside. Watch out for break below Double Bottom at 1.2110 for downside continuation.