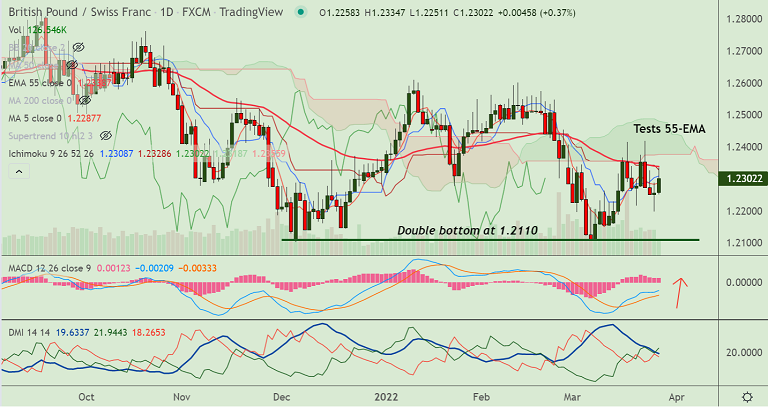

Chart - Courtesy Trading View

Technical Analysis: Bias turning Bullish

- GBP/CHF was trading 0.31% higher on the day at 1.2294 at around 10:40 GMT

- The pair is extending gains after Doji formation on the previous session's candle

- MACD and ADX support further upside in the pair

- Price action has held 20-DMA support and weakness only on break below

- 200H MA is immediate resistance at 1.23 mark, decisive break above will fuel further gains

Support levels - 1.2286 (5-DMA), 1.2241 (20-DMA), 1.2197 (Previous weeks low)

Resistance levels - 1.23, 1.2338 (55-EMA), 1.2374 (Cloud base)

Summary: GBP/CHF poised for further gains. Scope for test of daily cloud resistance at 1.2374. Break into cloud will propel the pair higher.