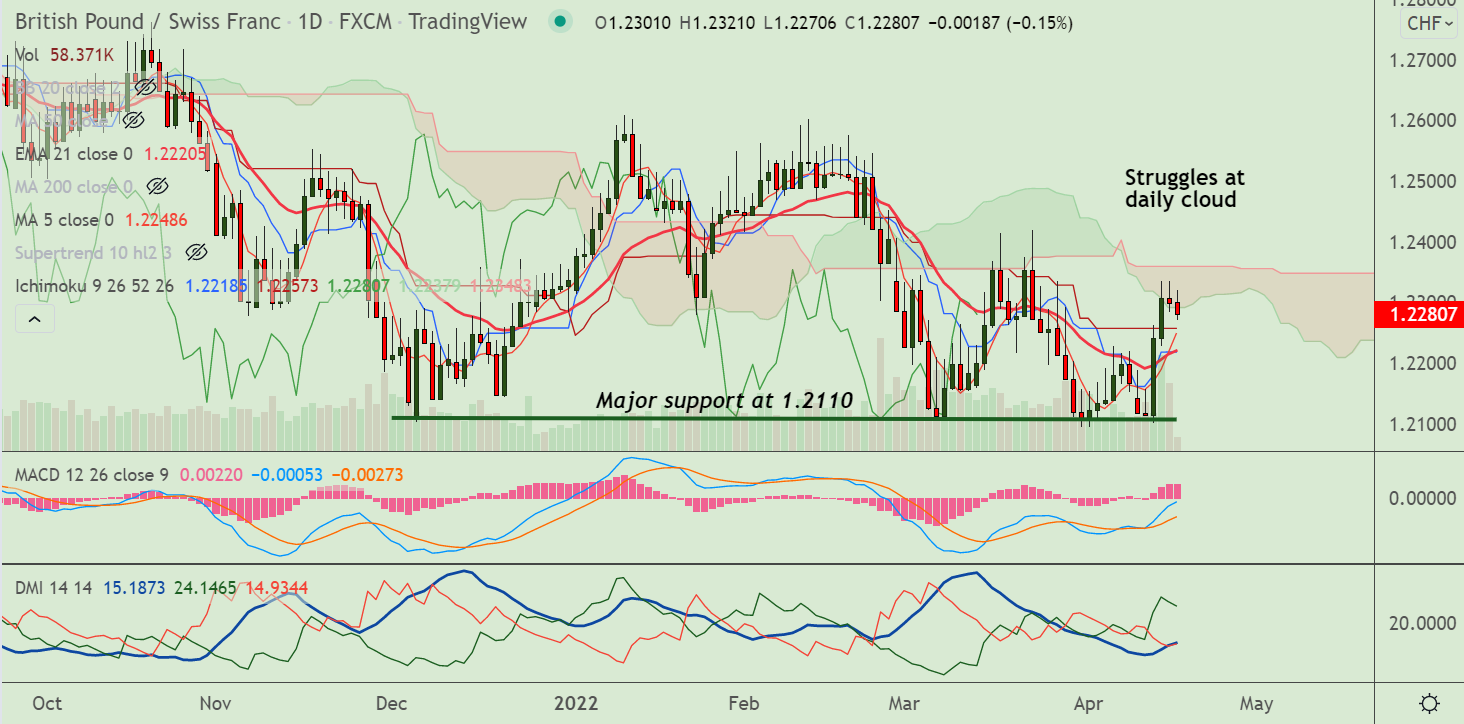

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral with a bullish tilt

- GBP/CHF was trading 0.12% lower on the day at 1.2285 at around 11:45 GMT

- The pair has formed back to back spinning tops at highs, denting upside in the pair

- Price action has found stiff resistance at daily cloud and further gains only on break above

- GMMA indicator shows major trend is bearish, while minor trend has turned bullish

- MACD and ADX support upside in the pair, Chikou span is biased higher

Support levels - 1.2274 (55-EMA), 1.2250 (5-DMA), 1.2203 (20-DMA)

Resistance levels - 1.2339 (110-EMA), 1.2359 (Cloud top), 1.2395 (55-week EMA)

Summary: GBP/CHF was trading capped between 55 and 110 EMAs, breakout will provide a clear directional bias.