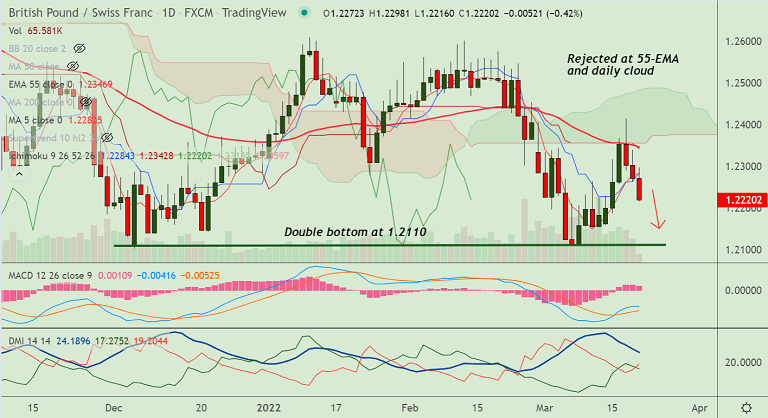

Chart - Courtesy Trading View

GBP/CHF was trading 0.39% lower on the day at 1.2224 at around 10:30 GMT.

The pair is extending weakness for the 3rd consecutive session, scope for further downside.

Recovery attempts were capped at 55-EMA and daily cloud resistance, upside only on break above.

Price action has slipped below 200H MA support raising scope for further weakness.

GMMA indicator shows major and minor trend are strongly bearish. Price action is below major moving averages.

Support levels - 1.2159 (Previous week low), 1.2110 (Double Bottom), 1.21

Resistance levels - 1.2265 (5-DMA), 1.2283 (21-EMA), 1.2347 (55-EMA)

Summary: GBP/CHF trades with a bearish bias. The pair is poised to test Double Bottom at 1.2110.