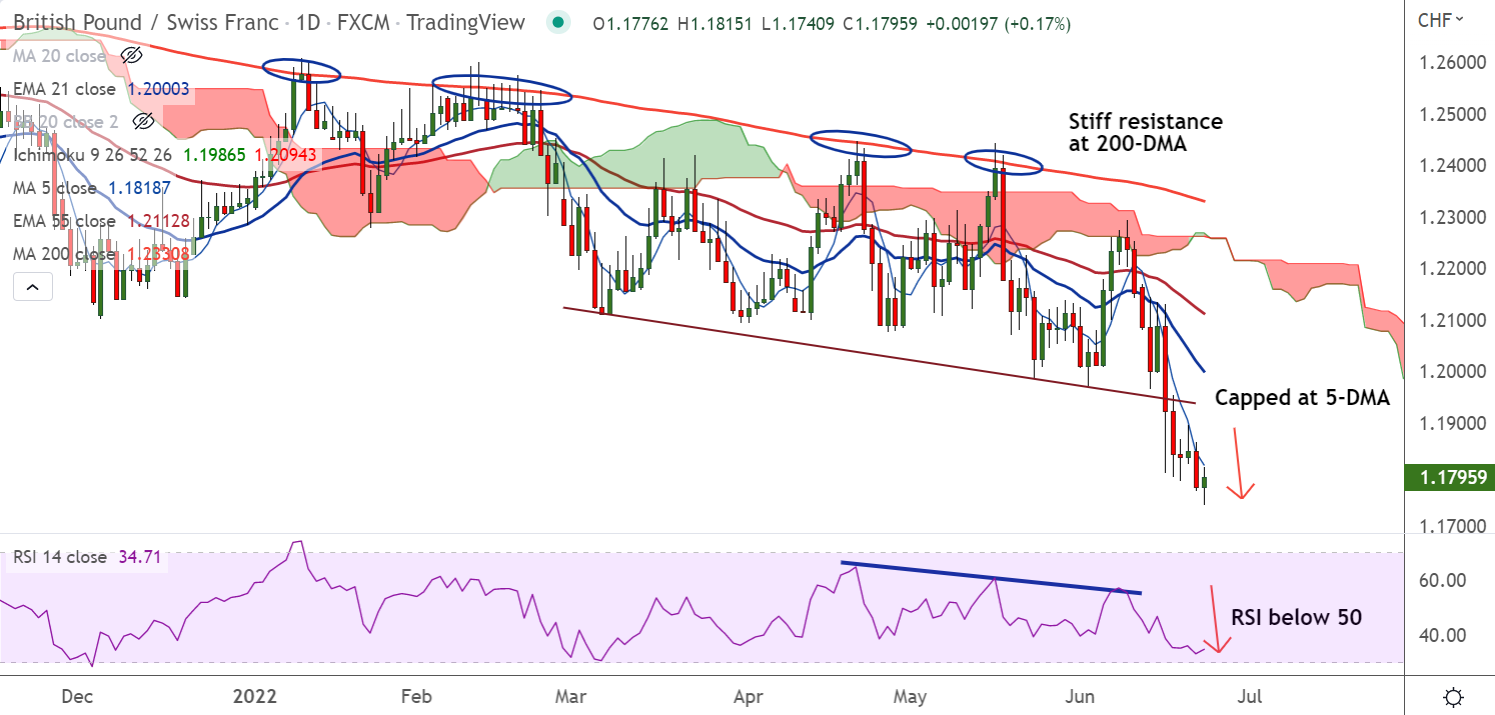

Chart - Courtesy Trading View

GBP/CHF was trading 0.10% higher on the day at 1.1789 at around 11:05 GMT. The pair has pared some losses and has edged higher from session lows at 1.1740.

Data released earlier on Thursday showed seasonally adjusted S&P Global/CIPS UK Manufacturing Purchasing Managers’ Index (PMI) dropped to 53.4 in June versus 53.7 expected and 54.6 – May’s final reading.

Meanwhile, the Preliminary UK Services Business Activity Index for June arrived at 53.4 when compared to May’s final score of 53.4 and 53.0 expected.

The Confederation of British Industry's (CBI) latest Distributive Trades Survey showed on Thursday, the UK’s Retail Sales Balance dropped to -5 in June versus May’s -1 print.

GBP/CHF trades with a bearish bias. Upside remains capped below 5-DMA which is sharply lower.

Momentum is bearish, volatility is high, scope for test of fresh multi-month lows at 1.1598 (Sept 2020 low).