GBPJPY trend has been extremely conducive for bears as we listed out series of red flags from technicals and fundamentals that signify serious weakness in this pair.

The pair has pretty much achieved our 1st targets at 177.125, T2 at 175 and for now an interim targets of 163.500 and even at 160 levels are pretty much on the table upon the breach of above stated supports.

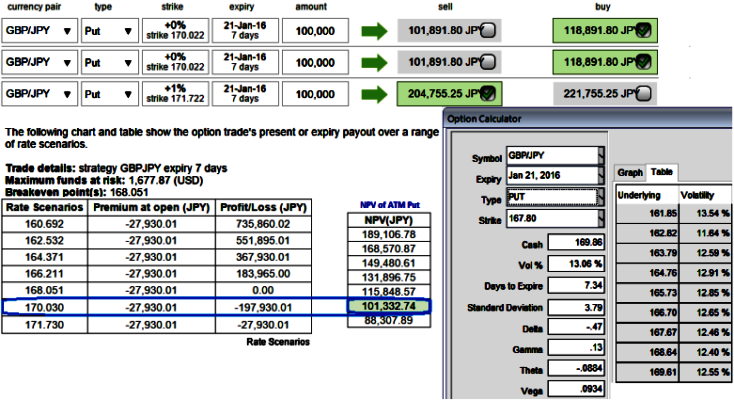

And in addition, as you can make out from the diagram the implied volatility for near month at the money contracts of GBPJPY pair has been highest among G7 currency segment and is seen at 13% for 1w expiry.

As shown in the diagrammatic representation, naked at the money put option with 7 days expiry trading 17% more than NPV and has descent delta at 0.50 with when gamma was at around 0.33 but this is not the same case with other strikes even though we've chosen in the money strikes.

The Vega on a long put option is directly proportional to IVs, so IV increases or decreases by 1%, the option's premium will increase or decrease proportionately. The Vega of a short (sell) option position is negative and an increasing IV is bad.

As shown in the sensitivity table, Gamma is responsible as to how much the Delta is supposed to change to the underlying rate moves by 1%.cBecause in the sensitivity table gamma shows how much the delta will shift for a corresponding underlying rate moves by 1%.

The Gamma is useful when using the underlying market to hedge options, since it gives an idea of how much more or less you need to hedge in the underlying market if the market price moves by 1%.

With reducing volatility gamma adds to the risk and reward profile for both holders and writers.

So, before these continued downswings may hamper your forex portfolio as we think the current downtrend holds stronger in long run, so we've tailored our formulation of strategies as the risk appetite varies from different investors to different traders.

With hedging perspectives, using IVs, gamma and vega factors in order to neutralize volatility factor, put back-spreads are advocated so as to reduce the sensitivity and focus on hedging motive.

Hence, go long on 2W 2 lots of at the money -0.47 delta puts with gamma at 0.25, vega at 0.095 and simultaneously shorting 3D (1%) In-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying At-The-Money Puts.

Note: The identical expiries used in diagram is only for demonstrate purpose, use shorter maturities on short side.

FxWirePro: GBP/JPY backspreads on balance with gamma and vega on higher IVs in place for hedging

Thursday, January 14, 2016 7:57 AM UTC

Editor's Picks

- Market Data

Most Popular