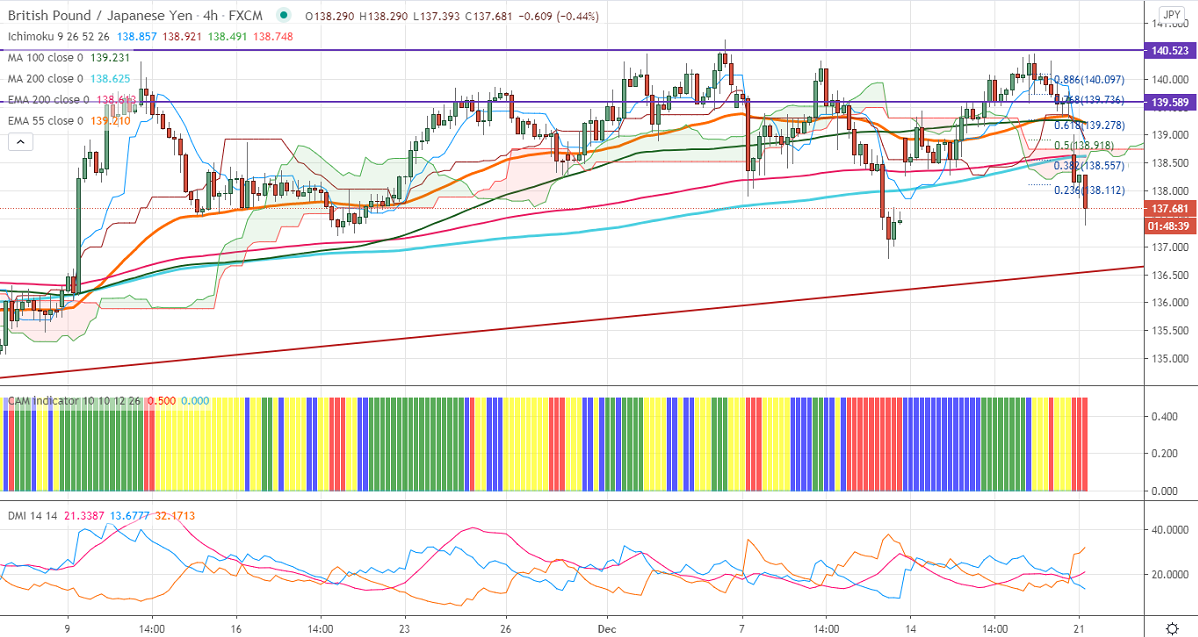

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- 139.15

Kijun-Sen- 139.15

GBPJPY lost more than 250 pips from the previous week's high of 140.44. The significant sell-off in GBPUSD as there is no chance of Brexit deal before Christmas and entire new lockdown in London due to surge in coronavirus case. The Pound sterling is trading below 1.3350, any decline below 1.3280 confirms bearish continuation. Markets eye UK PM Johnson COBRA meeting for further direction. The intraday trend of GBPJPY is bullish as long as resistance 139.50 holds.

Technical:

The pair has formed a temporary top around 140.70 and shown a good sell-off till 136.78. Any indicative break above 140.70 confirms trend continuation, a jump till 141.50/142. On the lower side, near term support is around 139.50, and any indicative break below targets 139/138.25/137.19.

It is good to buy on dips around 139.85-90 with SL around 139.50 for the TP of 142.