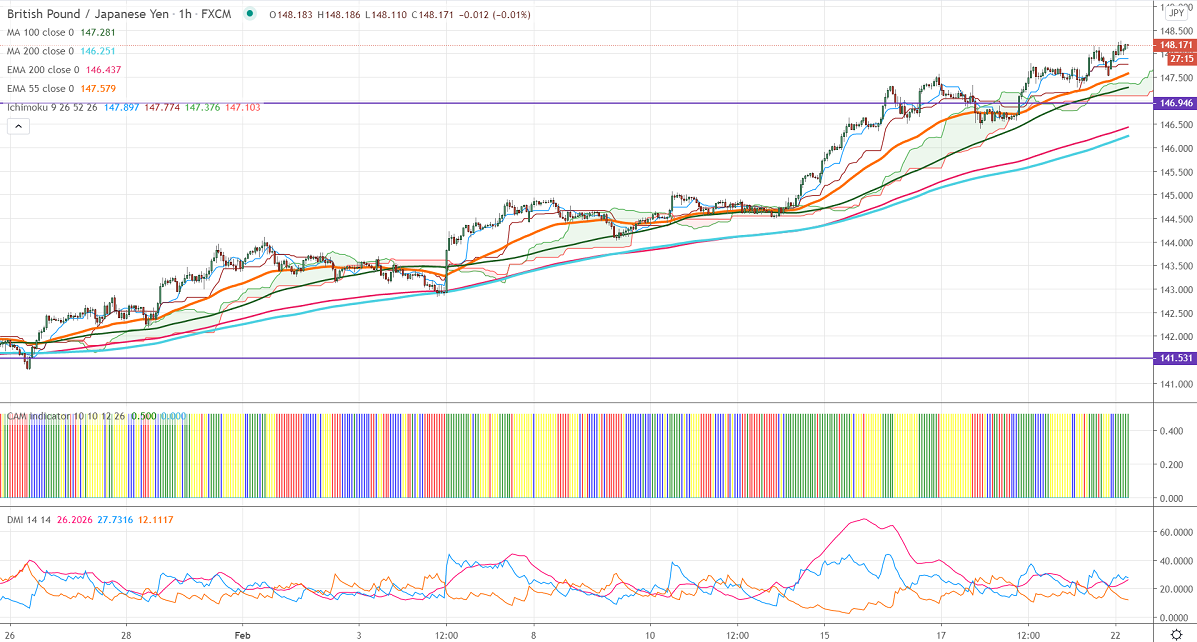

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 147.89

Kijun-Sen- 147.77

GBPJPY took support near 55- H EMA and shown a nice recovery of more than 50 pips on the strong Pound sterling. GBPUSD crossed 1.40 level as coronavirus vaccination roll out and easing lockdown restrictions in London. The weak UK retail sales have dragged the pound sterling from higher levels.USDJPY downside capped by 200- H MA, major up move only above 106.40. The intraday trend of GBPJPY is bullish as long as 147.20 holds.

Technical:

The pair is trading above significant resistance at 147.95, a jump till 150/151.20 possible. On the lower side, near-term support is around 147.50. An indicative break below will drag the pair down to 147.20/146.80/146.30. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (Hourly chart)

CAM indicator –Bullish

Directional movement index – bullish

It is good to buy on dips around 147.75-80 with SL around 147.20 for the TP of 150.