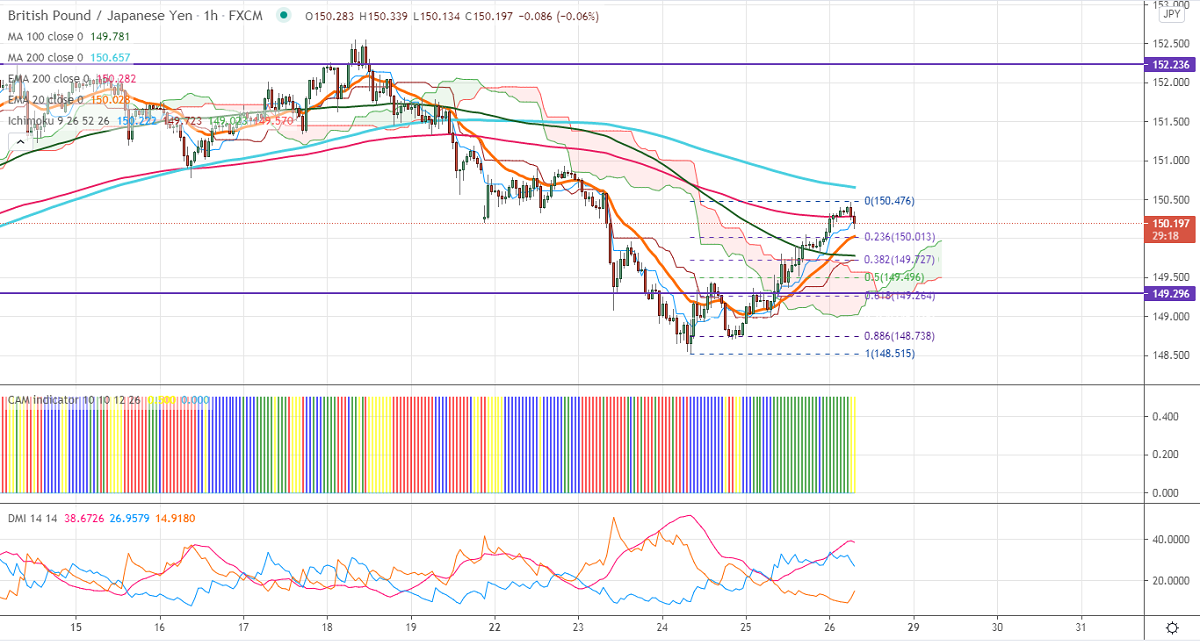

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 149.03

Kijun-Sen- 148.98

GBPJPY gained nearly 200 pips from a low of 148.50 level on weak yen. The yen is trading weak against the US on upbeat US real GDP and jobless claims. USDJPY is holding above 109 level, any surge past 109.36 confirms bullish continuation. The pound sterling is moving towards 1.3750 against the US dollar despite broad-based US dollar buying. The improvement in European Union and UK talks is supporting the pound at lower levels. The intraday trend of GBPJPY is bearish as long as resistance 150.31 holds.

Technical:

The pair's near-term resistance around 150.66 (200-H MA), any break above targets 151.20/152/152.55. On the lower side, near-term support is around 149.70. An indicative violation below will drag the pair down to 149.25/148.50. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above hourly Tenken-Sen, Kijun-Sen, and below Ichimoku cloud. This confirms the intraday trend of slightly bullish

Indicator (Hourly chart)

CAM indicator –Neutral

Directional movement index –Bullish

It is good to buy on dips around 149.75-80 with SL around 149 for the TP of 152.50.