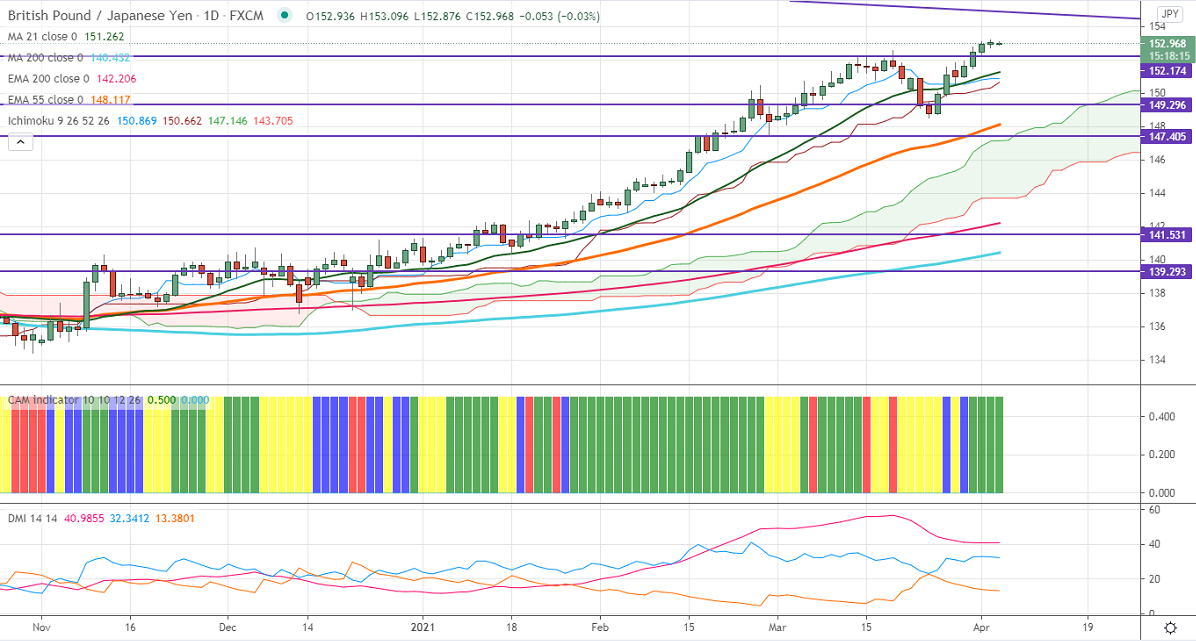

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 150.86

Kijun-Sen- 150.30

GBPJPY continues to trade higher for the past five months and surged more than five months on broad-based Yen selling. The surge in US bond yield is putting pressure on the yen. two days on the weak yen. USDJPY jumped sharply more than 450 pips and holding well above 110 level. Any violation above 111 confirms further bullishness. GBPUSD is holding above 1.3820 levels on a slight decrease in several new cases and around 10% population has been vaccinated the first dose in the UK. The intraday trend of GBPJPY is bullish as long as support 152.20 holds.

Technical:

The pair's near-term resistance around 153.25, any break above targets 153.75/155. On the lower side, near-term support is around 152.65. An indicative violation below will drag the pair down to 152/151.20. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above the daily Tenken-Sen, Kijun-Sen above Ichimoku cloud. This confirms the intraday trend of slightly bullish.

Indicator (4 Hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 152.25 with SL around 151.20 for the TP of 154.