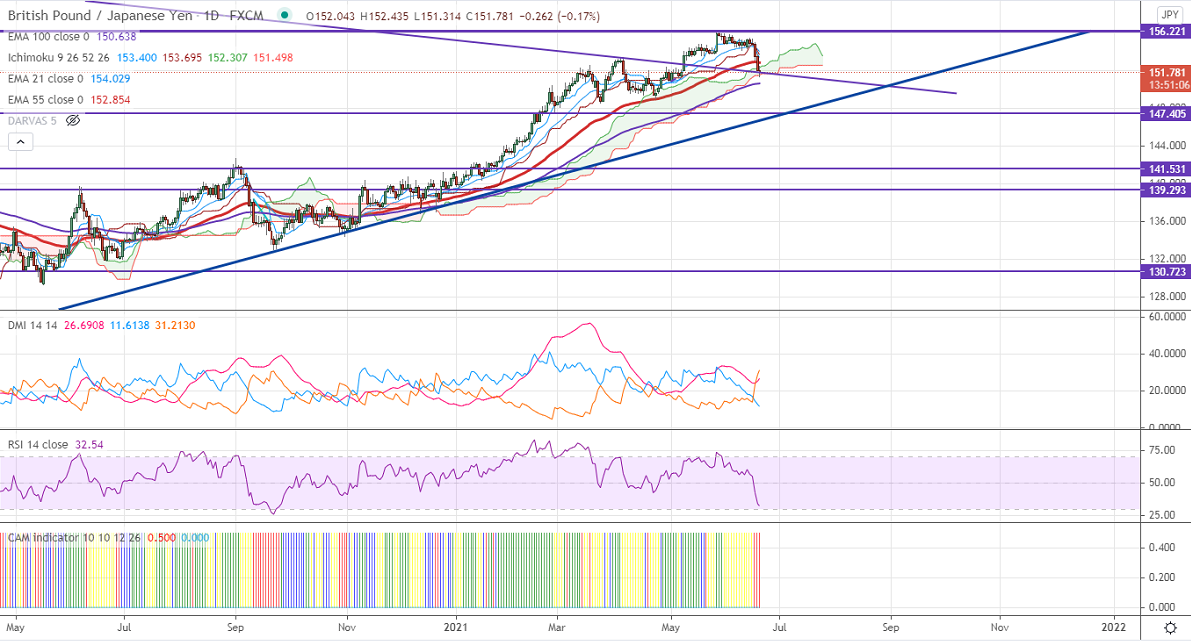

Ichimoku Analysis (Daily Chart)

Tenken-Sen- 153.72

Kijun-Sen- 154.02

GBPJPY continues to trade weak for a second consecutive week and lost more than 500 pips from a temporary top of 156.07 The board-based pound sterling selling is putting pressure on this pair. GBPUSD was one of the worst performers this week and shown a massive sell-off of more than 300 pips. After the hawkish Fed and Brexit dram and spread of delta variant, the surge in the US dollar is putting pressure on this pair. USDJPY is trading below 110 levels after a minor pullback till 110.82. Any breach above 111 confirms further bullishness. GBPJPY hits an intraday low of 151.30 and is currently trading around 151.55.

Technical:

The pair's near-term resistance around 152 any break above confirms intraday bullishness. A jump till 152.82/153.10/154. On the lower side, near-term support is around 151.30. Any indicative violation below that level will drag the pair down to 150.80/150. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well below daily Kijun-Sen, Tenken-Sen, cloud.

Indicator (Daily chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 152.45-50 with SL around 153.70 for a TP of 150.