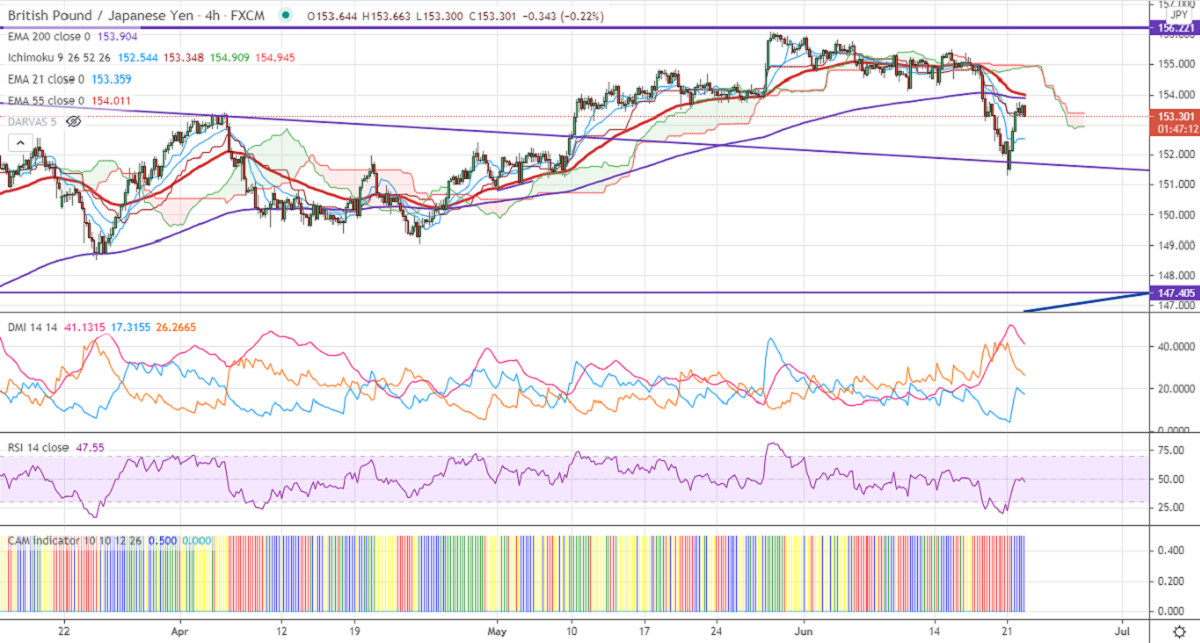

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.72

Kijun-Sen- 154.02

GBPJPY has shown a nice recovery of more than 150 pips on board-based yen weakness. The surge in US bond yields is putting pressure on the yen. USDJPY is holding well above 110 level, any break above 111 confirms significant bullishness. The nice pullback of more than 100 pips in pound sterling also supporting the pair at lower levels. GBPUSD is holding above 1.3900 levels. The Brexit concerns and delay in the reopening of the economy are preventing the pound sterling from the further jump. GBPJPY hits an intraday high of 153.77 and is currently trading around 153.562.

Technical:

The pair's near-term resistance around 153.91, any break above confirms intraday bullishness. A jump till 154.35/155/156.10 On the lower side, near-term support is around 153. Any indicative violation below that level will drag the pair down to 152/151.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading well above 4-Hour Kijun-Sen, Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator- Slightly Bullish

Directional movement index –Bearish

It is good to sell on rallies around 153.75-80 with SL around 154.60 for TP of 151.50.