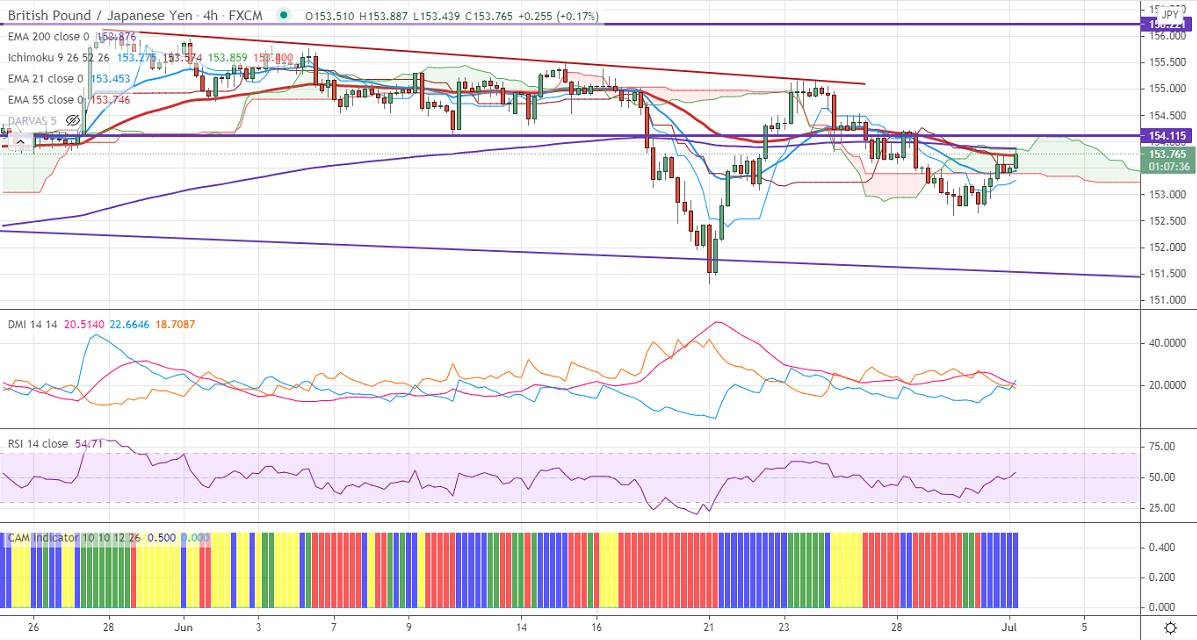

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.09

Kijun-Sen- 153.87

GBPJPY recovered sharply more than 100 pips on weak yen. USDJPY surged sharply and hits a 15-month high on board-based US dollar buying. Any breach above 111.20 confirms further bullishness. The pound sterling continues to trade weak against all majors. GBPUSD jumped lightly above 1.380 level, markets await BOE Bailey, UK final manufacturing PMI for further direction. GBPJPY hits an intraday low of 152.819 and is currently trading around 152.845.

Technical:

The pair's near-term resistance around 153.20, any break above targets 153.65/154/154.60/155.15. Significant trend reversal only if it breaks 156.60. On the lower side, near-term support is around 152.50. Any indicative violation below that level will drag the pair down to 152/151.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 4-Hourly Kijun-Sen, Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 153.80-85 with SL around 154.25 for a TP of 151.30.