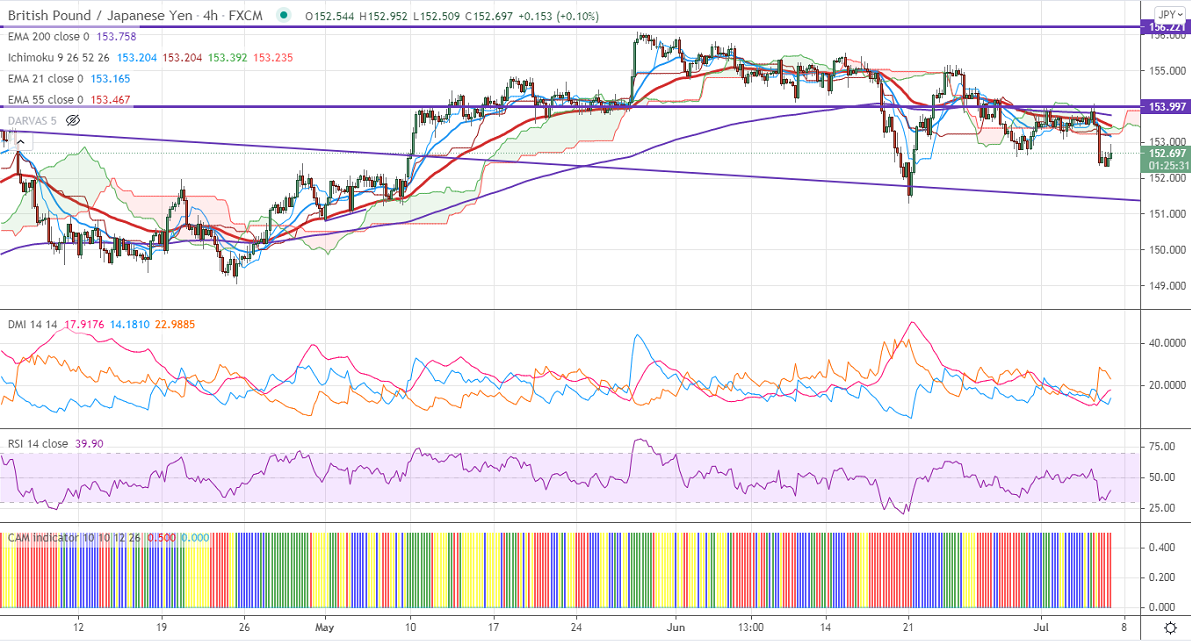

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 153.204

Kijun-Sen- 153.204

This week low – 152.33.

Yesterday's high -154.07

GBPJPY has lost more than 100 pips yesterday on pound sterling weakness. GBPUSD is hovering near 1.3800 despite weak US ISM services data. Markets eye US FOMC meeting minutes for further direction. The UK is ready to lift lockdown restrictions on July 19th and final approval on Jul 12th, 2021. USDJPY has taken support near 21-day MA, shown a minor jump. Any decline below 110.40 confirms the bearish trend. GBPJPY hits an intraday high of 152.95 and is currently trading around 152.56.

Technical:

The pair's near-term resistance around 153.15, any break above targets 153.50/153.75/154.22. Significant bullish continuation if it breaks 154.25. On the lower side, near-term support is around 152.30/151.80/151.30. Significant trend reversal only if it breaks below 151.30.

Ichimoku Analysis- The pair is trading above Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 153 with SL around 153.75 for a TP of 151.30.