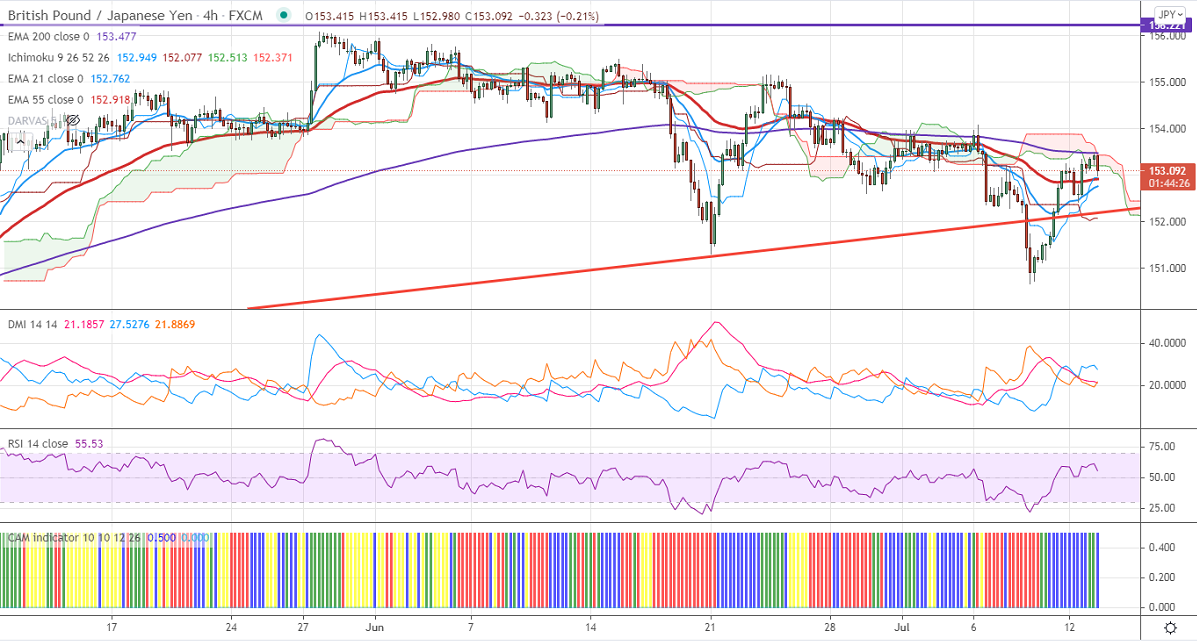

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.94

Kijun-Sen- 152.07

Previous week high – 154.22

GBPJPY is trading higher for third consecutive days on the strong Pound sterling. The strong UK retail sales and minor selling in the US dollar are supporting the pound sterling. The figures from the British retail consortium and KPMG show that retail sales rose to 28.4% compared to the second quarter of 2020, the highest level since 1995. USDJPY reversed most of its losses made on the previous week and holding well above 110 levels. GBPJPY hits an intraday high of 153.25 and is currently trading around 153.03.

Technical:

The pair's near-term resistance around 153.50, any break above targets 154.25./155.15/156.06.Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152.85. Any indicative violation below targets 152.40/152.40/150.65. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator-Bullish

Directional movement index –Bullish

It is good to sell on rallies around 153.55-60 with SL around 154.25 for a TP of 150.