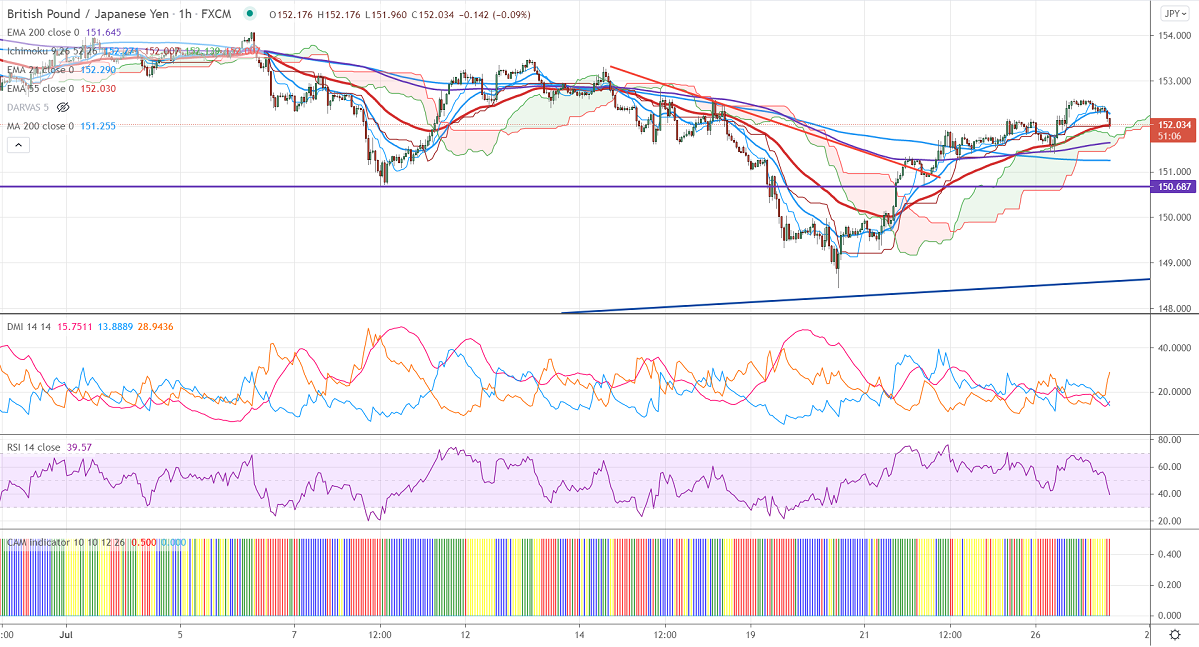

Ichimoku Analysis (1-Hour Chart)

Tenken-Sen- 152.34

Kijun-Sen- 152

Previous week high – 152.16

GBPJPY is trading higher for the past four days and surged more than 2.5% on board-based pound sterling buying. GBPUSD recovered after hitting 5- month low on declining coronavirus cases. The number of coronavirus cases was down for the sixth consecutive day.GBPJPY hits an intraday low of 152.09 and is currently trading around 152.16.

Technical:

The pair's near-term resistance is around 152.60, any break above targets 153/153.30/154. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 151.40. Any indicative violation below targets 150.60/150/149. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 1-hour Tenken-Sen and below Kijun-Sen.

Indicator (1-Hour chart)

CAM indicator-Bearish

Directional movement index –Bearish

It is good to sell on rallies around 151.95-52 with SL around 153 for TP of 150.