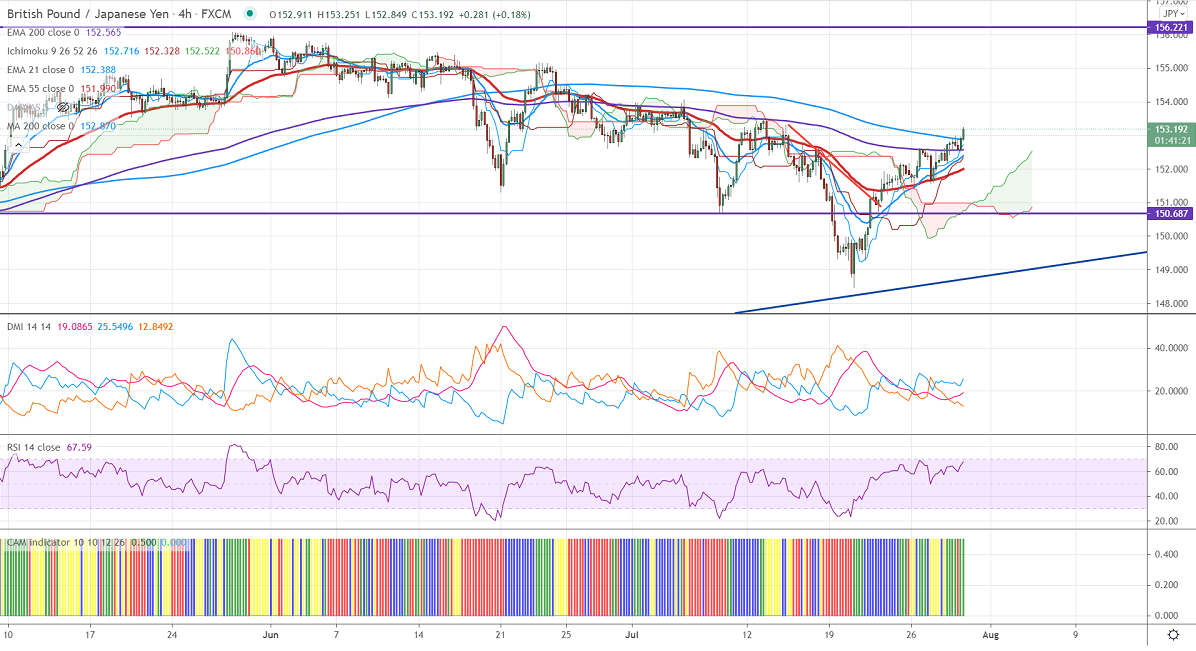

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.589

Kijun-Sen- 152.21

Previous week low – 148.45

GBPJPY is trading higher for the past one week on board-based Pound sterling buying. GBPUSD surged after dovish comments from Fed Chairman Powell. The par is holding well above 1.3900 supported by a decline in delta variant coronavirus and Brexit optimism. The intraday trend is bullish as long as support 152 holds. GBPJPY hits a high of 153.015 and is currently trading around 152.35.

Technical:

The pair's immediate resistance is around 153, any breach above targets 153.50/154/155. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152. Any indicative violation below targets 151.40/150.60/150/149. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading below 4-hour Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator-Bullish

Directional movement index –Bullish

It is good to buy on dips around 152.70-75 with SL around 152 for TP of 155.