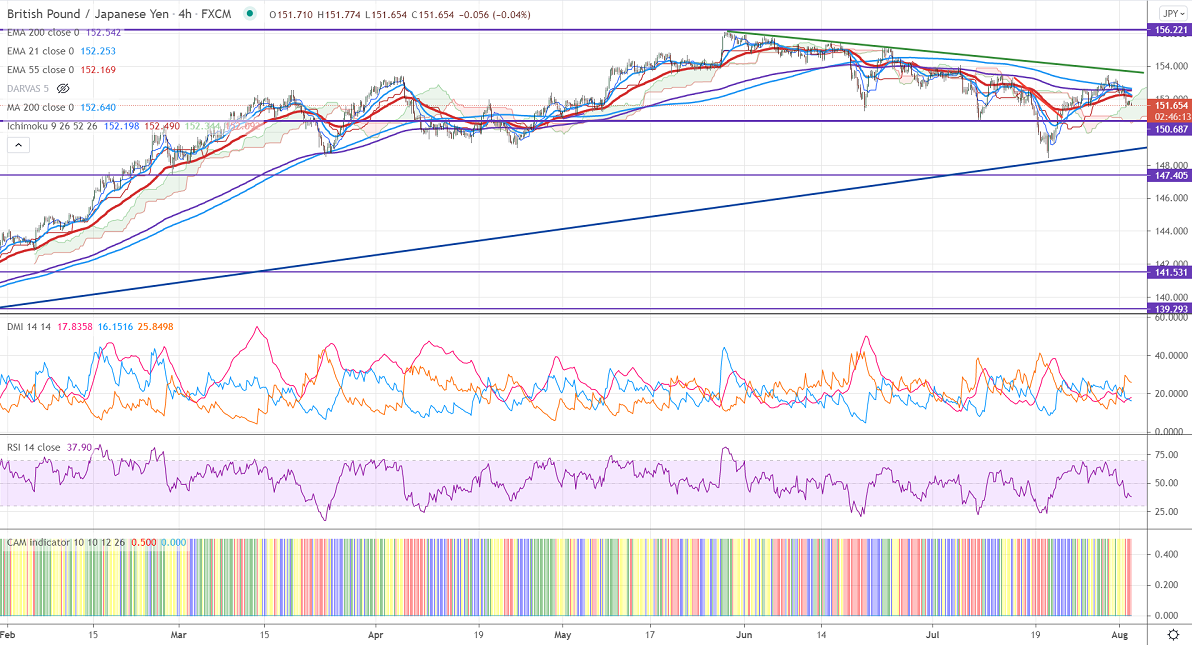

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.19

Kijun-Sen- 152.49

Previous week low – 148.45

GBPJPY continues to trade weak for the past three days. The pair pared most of its gains made the previous week on board-based Japanese yen buying. The spread of coronavirus especially in China has increased demand for safe-haven assets like the yen. The initial bias for the week remains bearish neutral as long as resistance 153.50 holds. The declining US bond yields also supporting the yen. GBPUSD has shown a minor profit booking despite falling coronavirus.

Technical:

The pair's immediate resistance is around 152.25, any violation above targets 152.65/153/153.50. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 151.40. Any indicative violation below targets 150.60/150/149.

Ichimoku Analysis- The pair is trading below 4-hour Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator- Bearish

Directional movement index –Bearish

It is good to sell on rallies around 152.50-55 with SL around 153.50 for a TP of 149.