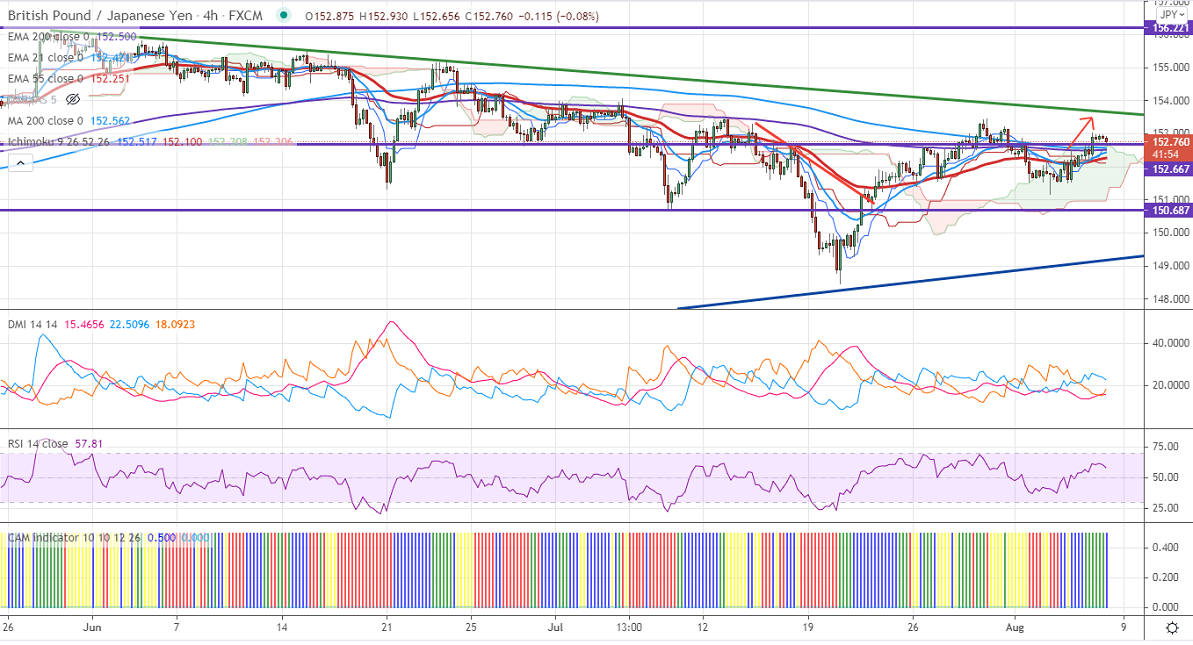

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.51

Kijun-Sen- 152.10

Previous week high – 153.45

GBPJPY is trading higher after the Bank of England monetary policy. The central bank has kept its rates unchanged as expected and raised its inflation forecasts to 4% in 2021 Q4 and 2022 Q1. GBPUSD is holding well above 1.3900, any breach above 1.4000 confirms further bullishness.

The intraday trend of GBPJPY is still neutral as long as resistance 153.50 holds. The minor weakness in the Japanese yen against the US dollar after more than 100 pips.

Technical:

The pair's immediate resistance is around 153.50, any violation above targets 154/155.05/156. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152.49. Any indicative violation below targets 152/151.54/151.

Ichimoku Analysis- The pair is trading above 4-hour Tenken-Sen and below Kijun-Sen.

Indicator (4-Hour chart)

CAM indicator- Bullish

Directional movement index –Neutral

It is good to buy on dips around 152.50-55 with SL around 151.40 for a TP of 155.