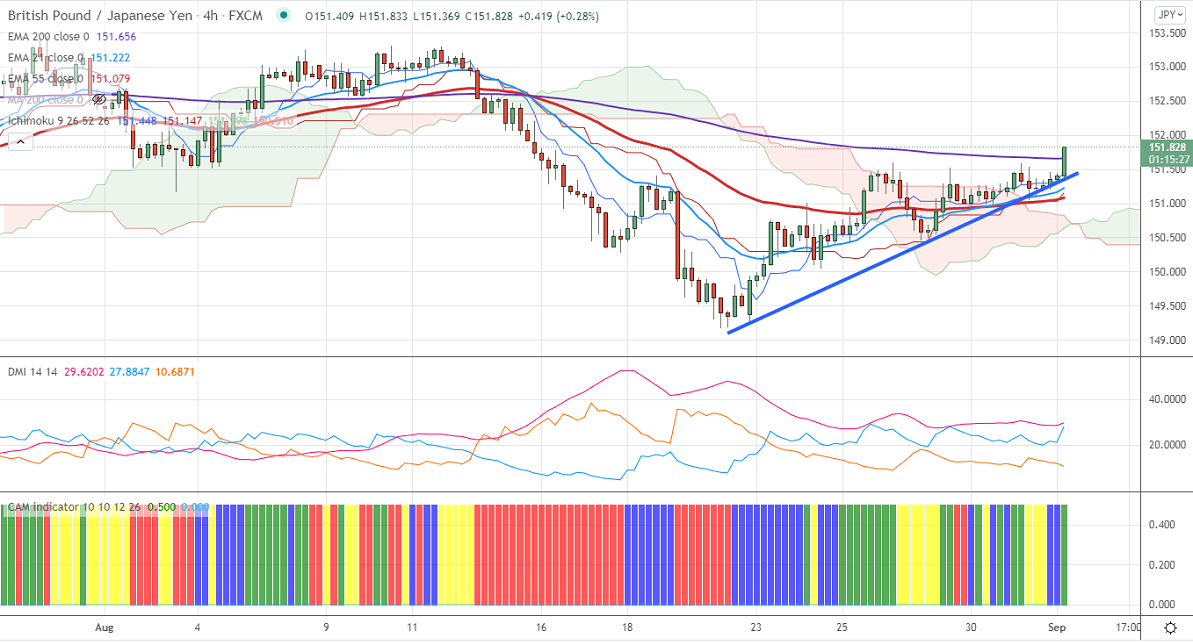

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 151.32

Kijun-Sen- 151.02

Previous week high – 153.45

GBPJPY rebounds sharply after hitting a low of 151.05. The weakness in Yen is due to upbeat market sentiment and a jump in US treasury yield. The minor sell-off in Pound sterling on Brexit pessimism and coronavirus concerns is preventing the pair from upside. GBPUSD trades above 1.3750; any breach below 1.3730 confirms further bearishness. The intraday trend of GBPJPY is bullish as long as support holds.

USDJPY- Analysis

The pair has broken significant resistance 110.25, a jump till 110.80. Significant support is around 109.

Technical:

The pair's immediate resistance is around 151.75, any surge past targets 152/153. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 151. Any indicative violation below targets 150.45/149/148.45.

Ichimoku Analysis- The pair is trading above 4- hour Kijun-Sen and below Tenken-Sen

Indicator (4 Hour chart)

CAM indicator- Slightly Bullish

Directional movement index –Bullish

It is good to buy on dips around 151.55-60 with SL around 151 for a TP of 153.