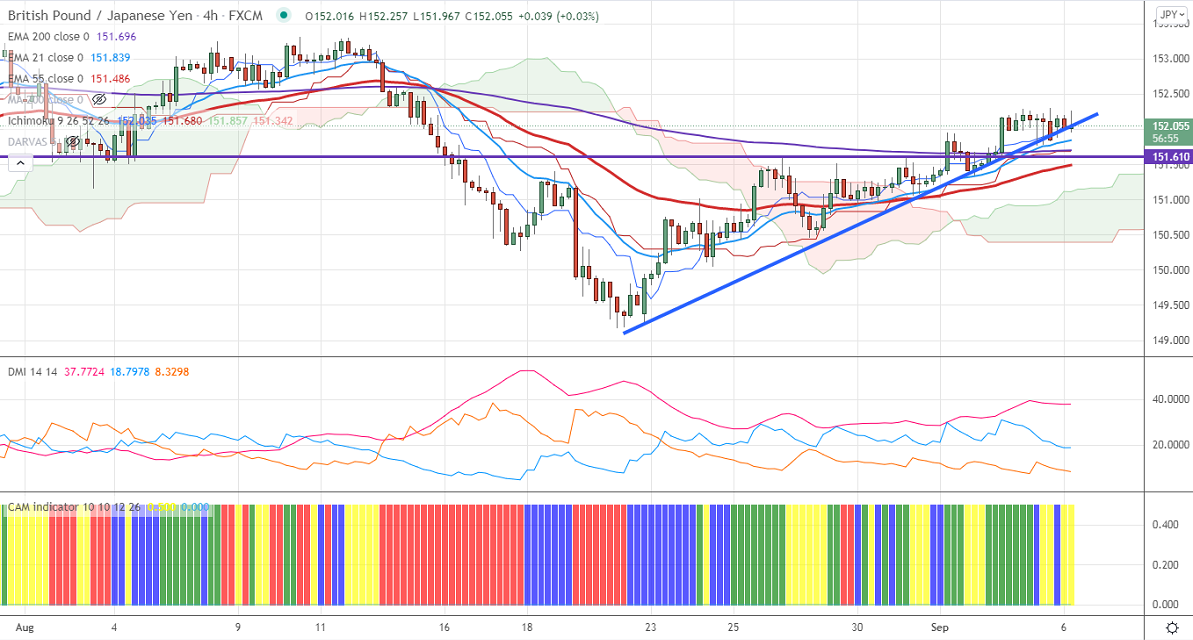

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.03

Kijun-Sen- 151.68

Major Intraday resistance -152.30

Intraday support- 151.75

GBPJPY is consolidating in a narrow range between 152.29 and 151.77. The minor decline in Pound sterling due to Post Brexit trading issues on Northern Ireland and spreading of delta variant coronavirus. The intraday trend of GBPJPY is bullish as long as support 151 holds.

USDJPY- Analysis

The pair regained after a minor decline post Nonfarm payroll. Significant resistance is around 110.40.

Technical:

The pair's immediate resistance is around 152.50, any surge past targets153/153.50. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 151.80. Any indicative violation below targets 151.30/151/150.45/149/148.45.

Ichimoku Analysis- The pair is trading above 1- hour Kijun-Sen and below Tenken-Sen

Indicator (Hourly chart)

CAM indicator- Slightly Bullish

Directional movement index –Bullish

It is good to buy on dips around 152 with SL around 151.30 for a TP of 153.50.