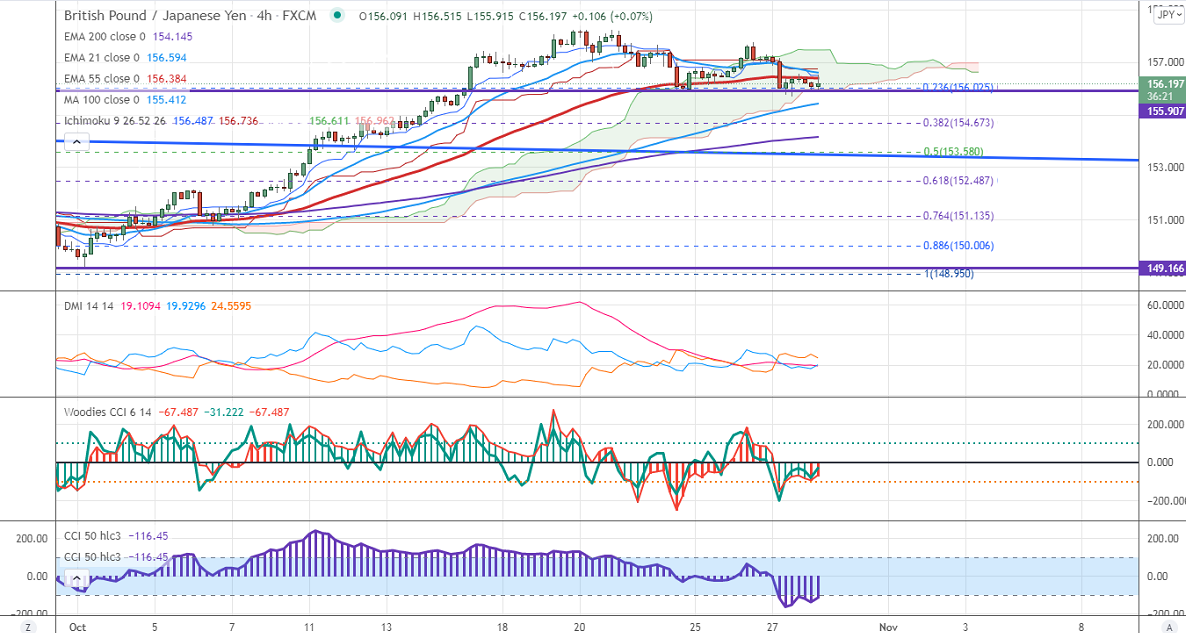

Major Intraday resistance -157.25

Intraday support- 155.70

GBPJPY continues to trade weak and has broken the previous week's low 155.90. It hits a low of 155.70 and is currently trading around 156.38.

The pound sterling has shown a minor recovery after hitting a low of 1.37093 despite Brexit worries. France has threatened to block UK ships is putting pressure on GBP at higher levels. The intraday trend of the pair is still bearish as long as resistance holds.

USDJPY- Analysis

The pair showed a minor sell-off after the BOJ status quo. Any breach below 113 will take the pair to next level 112.38.

CCI Analysis-

The Woodies CCI and CCI (50) are holding below zero level in the 4-hour chart. This confirms the bearish trend.

Technical:

The immediate resistance is around 156.75, any break above targets 157.25/157.66/158/158.25. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 156.50. Any indicative violation below targets 155.70/155/154.12.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 156.95-57 with SL around 157.50 for a TP of 155.90.