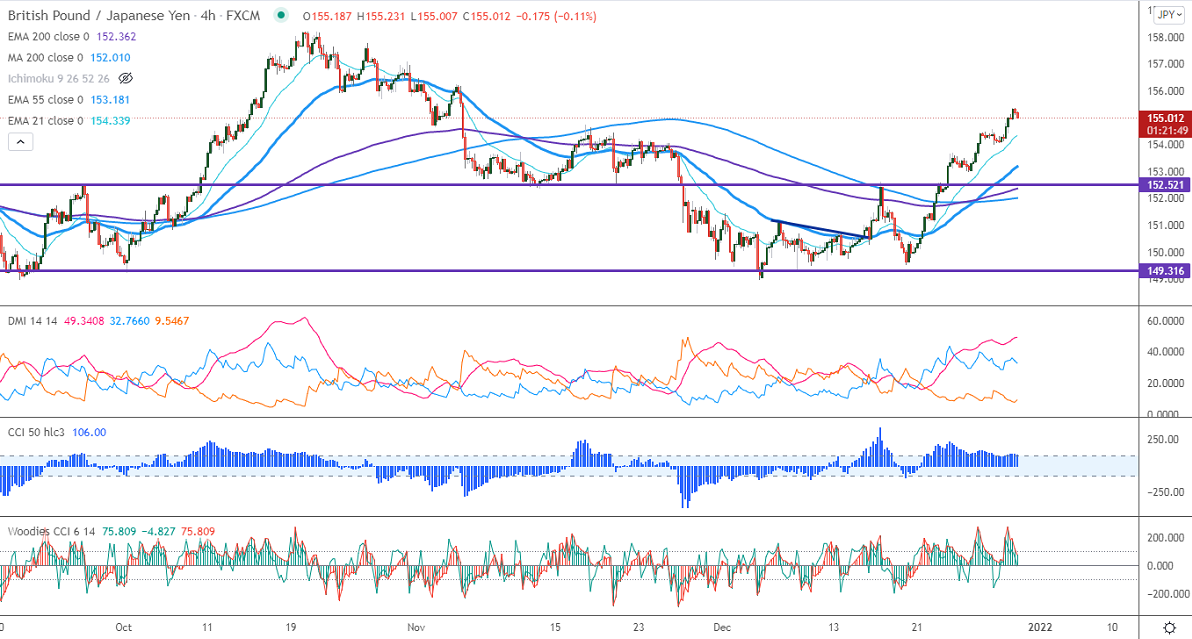

Short-term resistance -155.50

Intraday Support- 154

GBPJPY hits one and a half months high on weak yen. The pair surged more than 600 pips from a low of 149.04.GBP declined nearly 40 pips after hitting a high of 1.35050 on a rise in omicron cases. The number of new corona cases in the UK reached an all-time high at 1,83037. Any breach below 1.3520 confirms intraday bullishness. The intraday trend of GBPJPY is bullish as long as support 154 holds. GBPJPY hits an intraday high of 155.05 and is currently trading around 155.04.

USDJPY- Analysis

The pair hits a fresh monthly high of 115.22 on the decrease in demand for safe-haven assets. Any bullish continuation only if it breaks 115.55.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero levels in the 4- hour chart. It confirms an intraday bullish trend.

Technical:

The immediate resistance is around 155.50, any break above targets 156.10/156.70/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 154.60. Any indicative violation below targets 154/153.30/152.80/152.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to buy on dips around 154.50 with SL around 153.80 for a TP of 156.50.