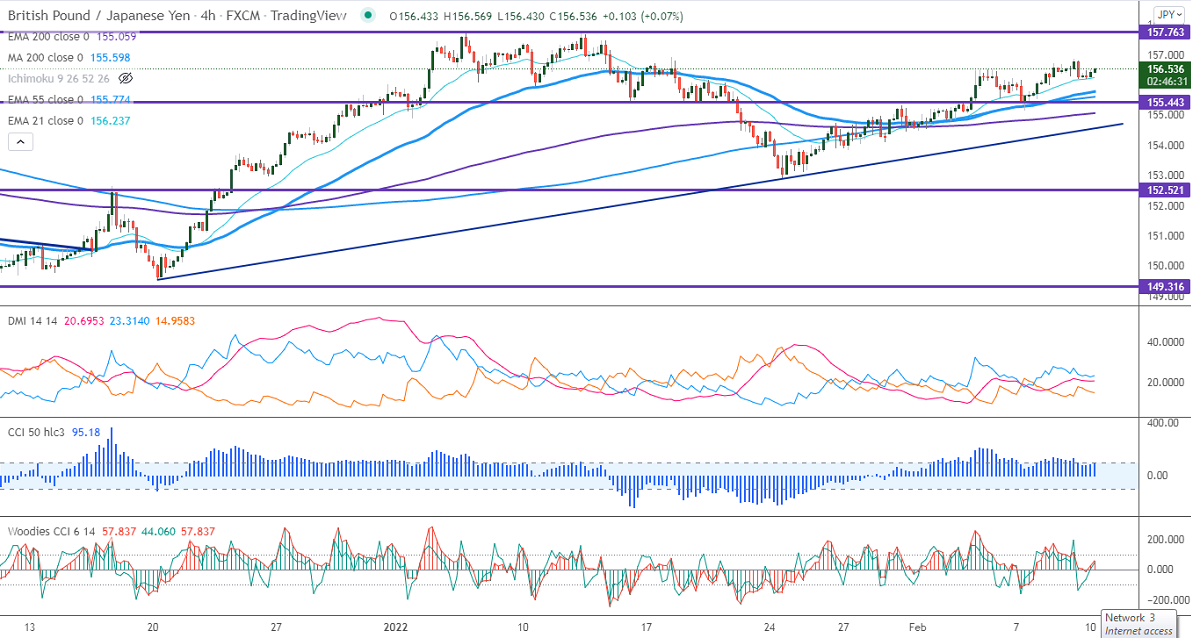

Short-term resistance -157

Intraday Support- 155

GBPJPY is consolidating between 155.13 and 156.85 for the past three days. Pound sterling under pressure on ongoing UK political uncertainty and Brexit issue. The hawkish Bank of England and yield differential is supporting GBP at lower levels. Any breach below 1.3490 confirms further bearishness. Markets eye BOE Chairman Speech today for further direction. The intraday trend of GBPJPY is bullish as long as support 155 holds. GBPJPY hits a high of 156.56 and is currently trading around 156.55.

USDJPY- Analysis

The pair continues to trade higher ahead of US inflation data. The intraday bullishness if it breaks 115.70.

CCI Analysis-

The CCI (50) and Woodies CCI hold above zero levels in the 4 -hour chart. It confirms the bullish trend.

Technical:

The immediate resistance is around 156.70, any break above targets 157/157.75/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 155.50. Any indicative violation below targets 155/154/153/151.95/150.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to buy on dips around 156 with SL around 155 for a TP of 158.50.