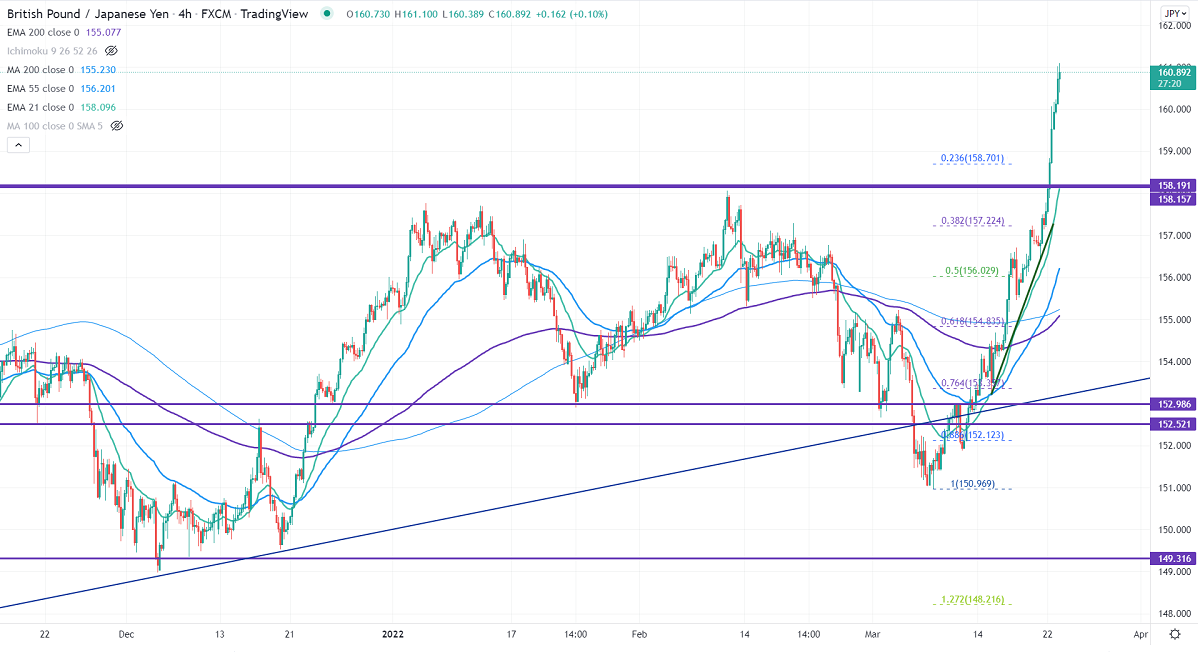

FxWirePro- GBPJPY Daily Outlook

Short-term resistance - 161

Intraday Support- 159.30

GBPJPY races higher and holds above 160 level on weak yen. It hits the highest level since June 2016. The pullback in pound sterling against the USD also supports the pair at lower levels. Any breach above 1.3300 confirms further bullishness. The intraday trend of GBPJPY is bullish as long as support 160 holds. GBPJPY hits an intraday high of 160.93 and is currently trading around 160.88.

USDJPY- Analysis

The pair has made a fresh high since Jan 2016 on surging US treasury yield. A jump to 122.65 is possible.

CCI Analysis-

The CCI (50) is above zero level in the 4-hour chart. The directional movement index shows a bullish trend. It confirms the short-term trend is bullish.

Technical:

The immediate resistance is around 161, any break above targets 163.80/165. On the lower side, near-term support is at 160. Any indicative violation below targets 159.35/158.

It is good to buy on dips around 160 with SL around 159.30 for a TP of 163.80.