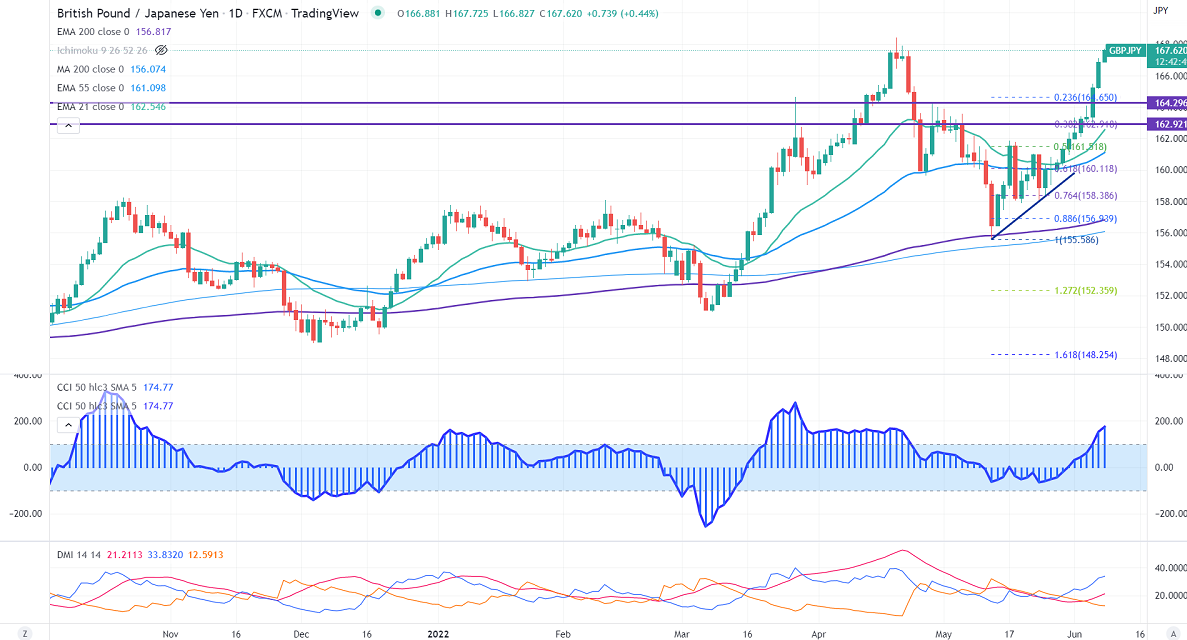

GBPJPY was one of the best performers this week and surged more than 400 pips on a weak yen. The pullback in Pound sterling from one week low as UK PM wins no-confidence vote. The political jitters and Brexit pessimism prevent the Pound sterling from further jumping. Any close above 1.2670 confirms further bullishness. GBPJPY hits an intraday high of 167.45 and is currently trading around 167.30.

USDJPY

USDJPY hits a fresh 20-year high on surging US treasury yield. A jump to 134.59 is possible.

Technicals:

On the lower side, immediate support is around 166.25, below will drag the pair to the next level to 165.29/164.65/164. The minor resistance to be watched is at 168.50 a break above that level confirms intraday bullishness, and a jump to 170/172 is possible.

It is a good buy on dips around 166.50 with SL around 165 for TP of 170.