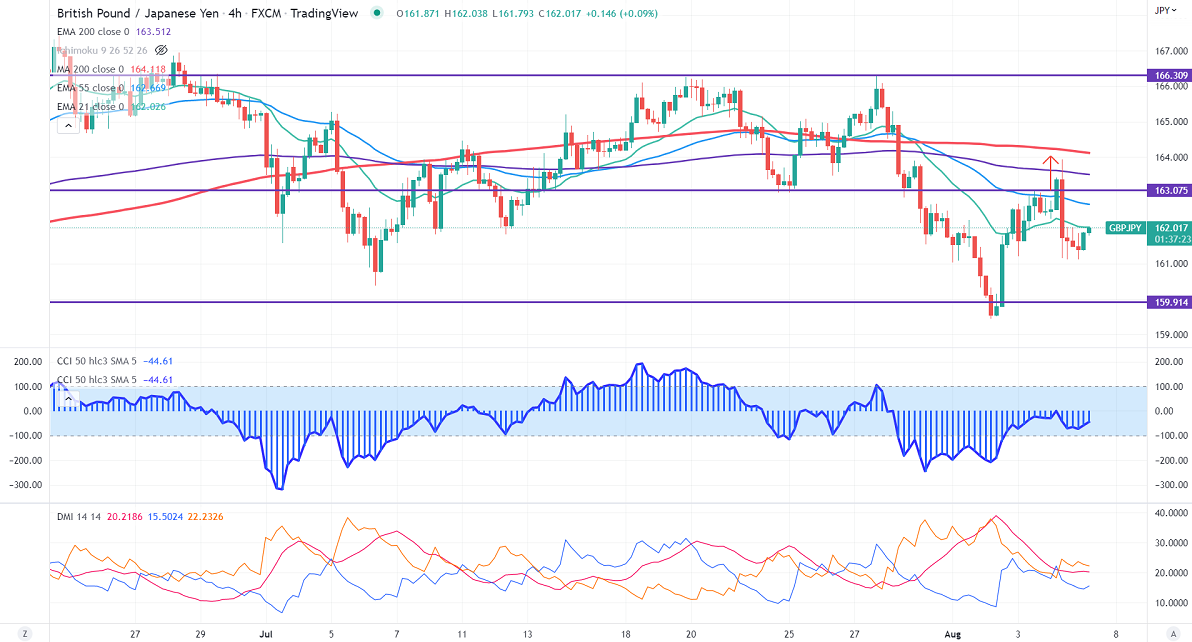

GBPJPY pared most of its gains after the Bank of England monetary policy. The central bank hiked rates by 50 bpbs to 1.75%, the biggest increase in 27 years. It has forecast 13% inflation by end of the year and warned of recession later this year. The pound sterling declined sharply against the US dollar , any breach below 1.060 confirms further bearishness. Technically in the hourly chart, the pair is holding below short-term 21-EMA, above 55 EMA, and long-term 200 EMA (162.87). Any violation below 161 will drag the pair to 160/159/158. GBPJPY hits an intraday high of 162.02 and is currently trading around 161.91.

The near-term resistance is around 162.50, a breach above targets 163.05/164.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 162.55-60 with SL around 163.25 for TP of 16