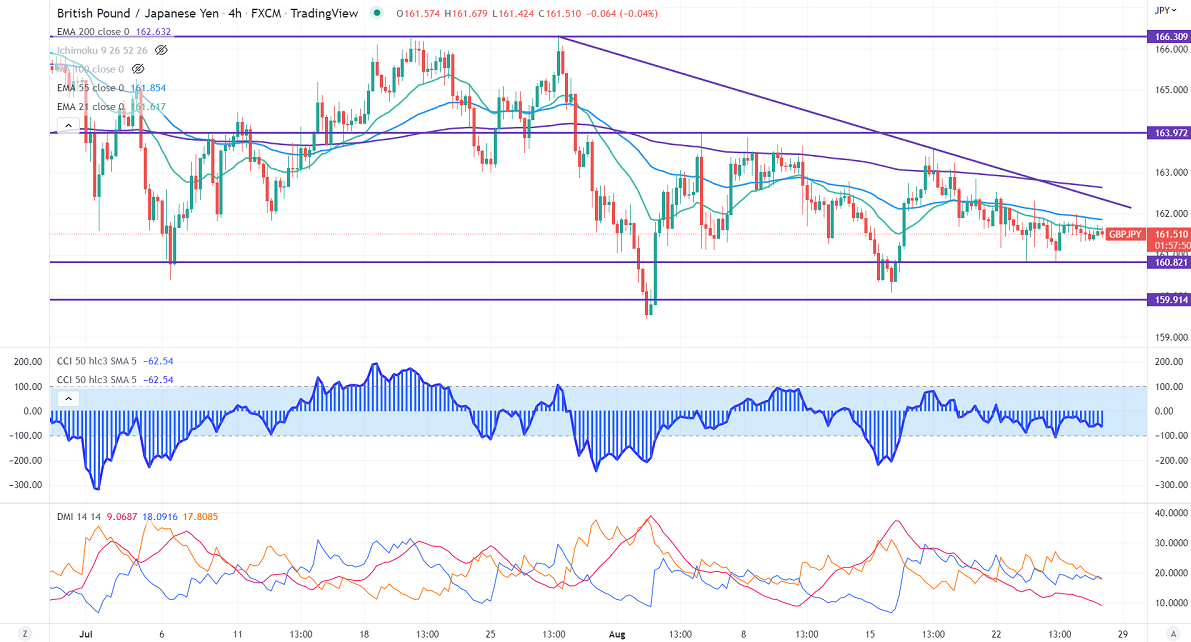

GBPJPY is trading flat between 162.31 and 160.83 for the past three days. The pound sterling recovered above 1.1800 ahead of the Fed chairman's speech at the Jackson hole symposium. The pound sterling upside is capped as rising energy prices due to Russia and Ukraine war will affect the growth of the UK. Technically in the 4-hour chart, the pair is holding below short-term 21-EMA, 55 EMA, and below long-term 200 EMA (162.78). Any violation below 160.80 takes to the next level 160/159/158.GBPJPY hits an intraday high of 161.718 and is currently trading around 161.49.

The near-term resistance is around 162, a breach above targets 162.50/163/ 164.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 161.75-80 with SL around 162.50 for TP of 159.