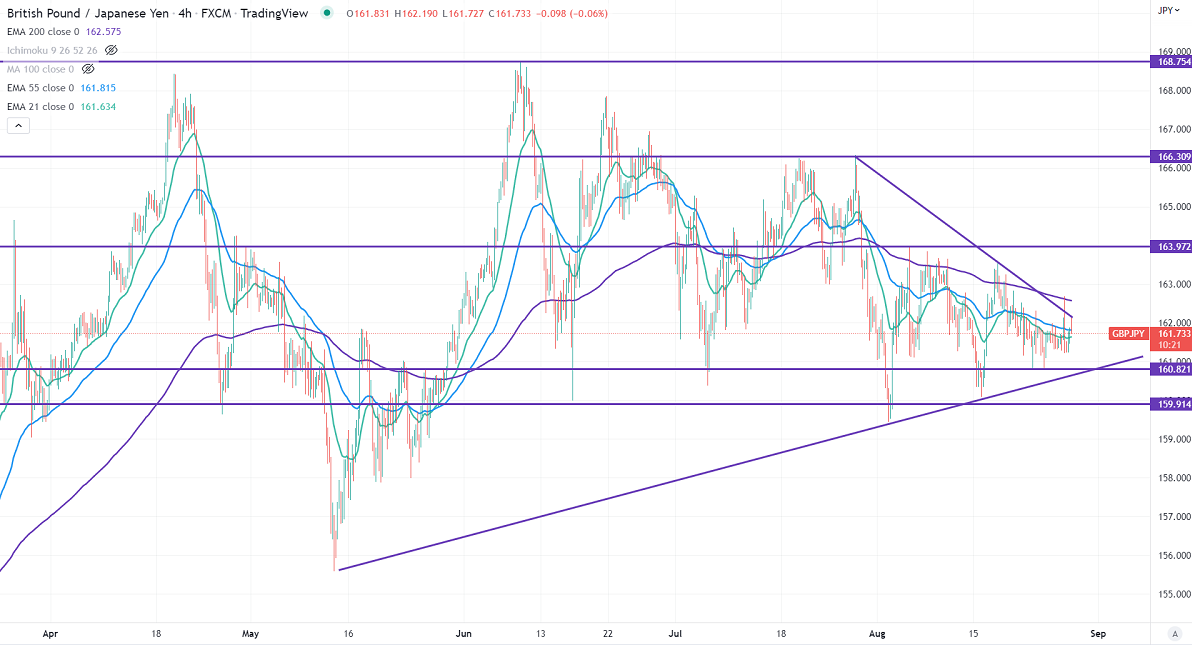

GBPJPY trades flat despite weak pound sterling. It has lost its shine against the dollar and hit the lowest level since Mar 2020 on UK recession fears due to a surge in energy costs. US Fed chairman Powell's hawkish speech in Jackson hole also puts pressure on the cable. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and below long-term 200 EMA (162.58). Any violation below 161.45 takes to the next level 160.80/159/158. GBPJPY hits an intraday high of 162.18 and is currently trading around 161.89.

The near-term resistance is around 162, a breach above targets 162.50/163/164.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 162.15-20 with SL around 163 for TP of 159.