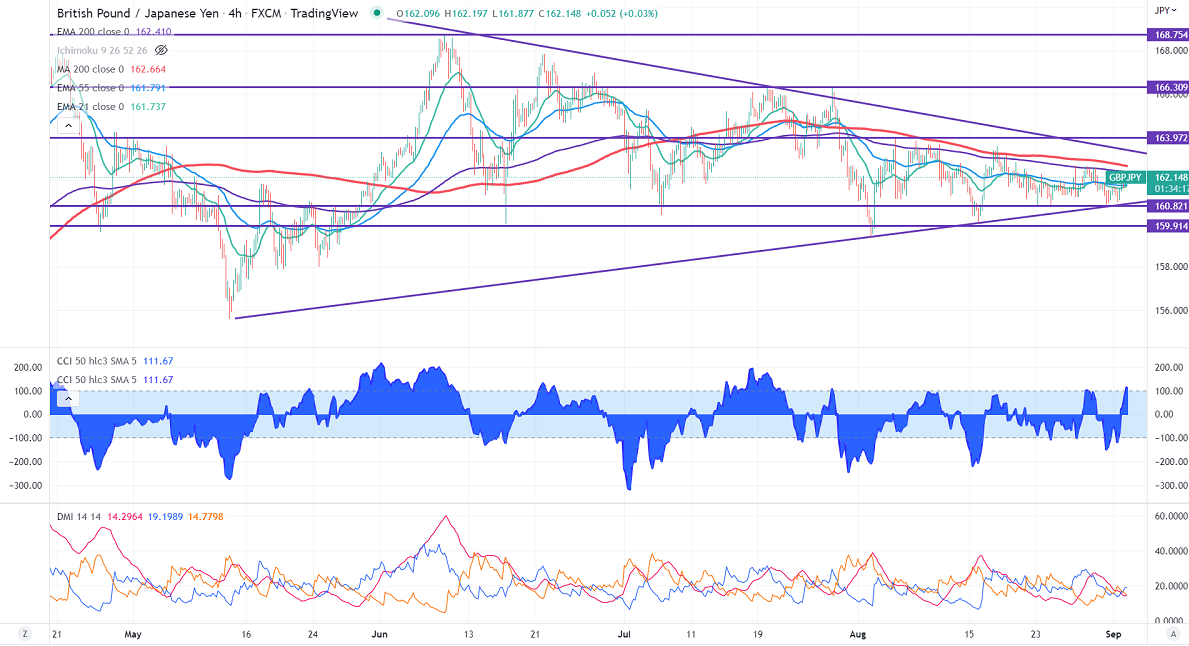

GBPJPY holds above 162 on a weak yen. The yen is trading weak against US Dollar and hits a fresh 24-year high.on policy divergence between the Fed and the Bank of Japan. The weakness in sterling puts pressure on the pair at higher levels. Market eyes US NFP data for further direction. Technically in the 4-hour chart, the pair is holding above short-term 21-EMA, 55 EMA, and below long-term 200 EMA (162.45). Any violation below 161.60 takes to the next level 160.80/159/158. GBPJPY hits an intraday high of 162.19 and is currently trading around 162.07.

The near-term resistance is around 162.60, a breach above targets 163/164.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to avoid it till further confirmation.