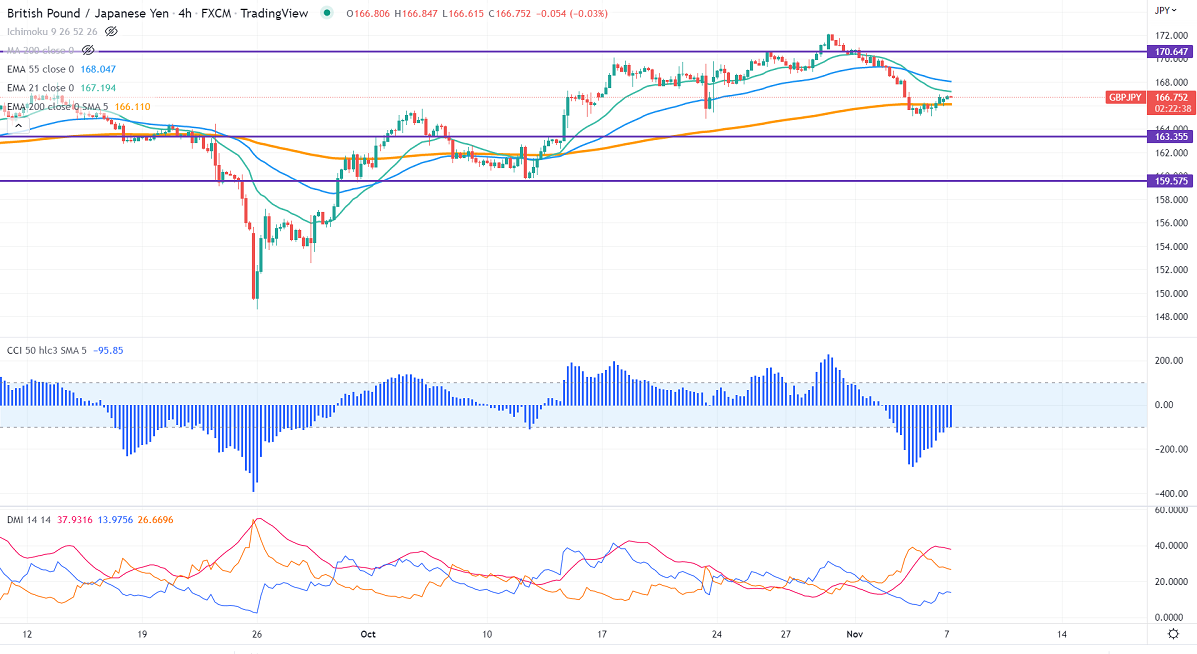

GBPJPY showed a minor pullback on the strong Pound sterling. It gained sharply against the US dollar after weak US Non-Farm payroll data. The jump in the US unemployment rate pushed cable higher. Markets eye the UK budget for further direction. The UK government considering more tax hikes and spending cuts to fix the fiscal hole. A violation above 1.1430 confirms further bullishness, a jump to 1.1500 is possible. Technically in the 4-hour chart, GBPJPY holds below short-term 21-EMA, 55- EMA, and above long-term 200 EMA (166.09). Any convincing close below 165 will drag the pair to the next level 163.90/163. GBPJPY hits an intraday high of 166.89 and is currently trading around 166.84.

The near-term resistance is around 167.40, a breach above targets 168.25/169

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Neutral

It is good to sell on rallies around 167 with SL around 168 for a TP of 163.95.