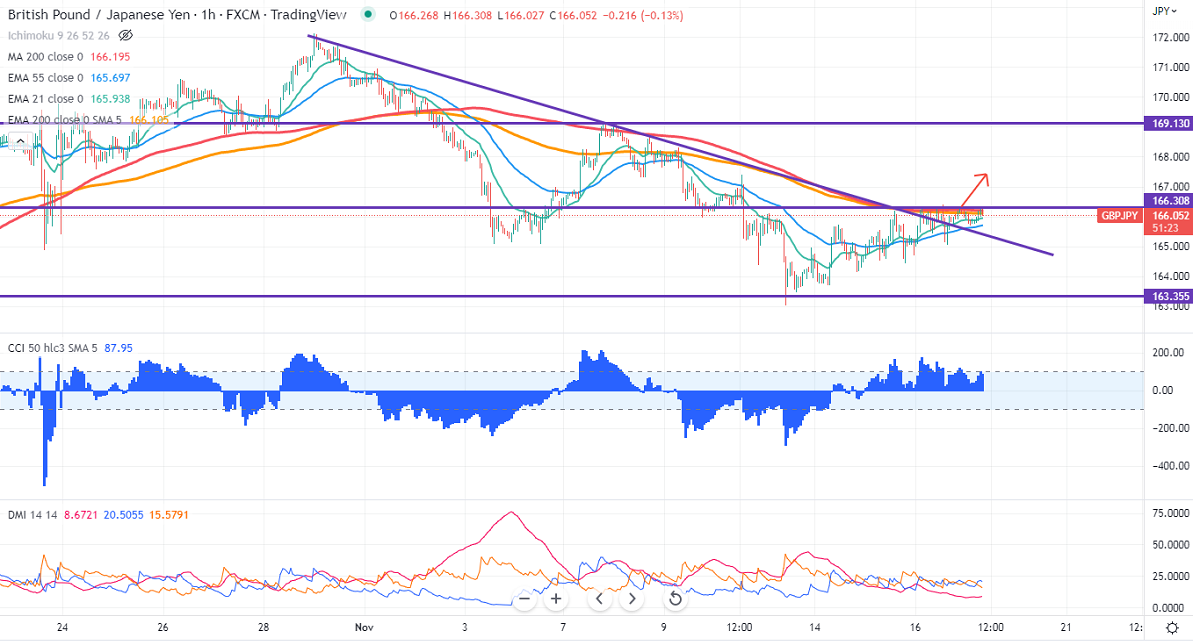

GBPJPY consolidates in a narrow range between 165.04 and 166.38 for the past two days. The pound sterling recovered above 1.1900 ahead of the UK budget. Any close above 1.1950 confirms further bullishness; a jump to 1.2000/1.2100 is possible. Technically in the 1-hour chart, GBPJPY holds above 21-EMA, 55- EMA, and long-term 200 EMA (166.19). Any convincing hourly close above 166.30 will take to the next level 166.75/167.61/168.50. GBPJPY hits an intraday high of 166.28 and is currently trading around 166.08.

The near-term support is around 165, a breach below targets 164.40/163.65/163.

Indicators (1-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to buy above 166.30 with SL 165.55 for a TP of 168.