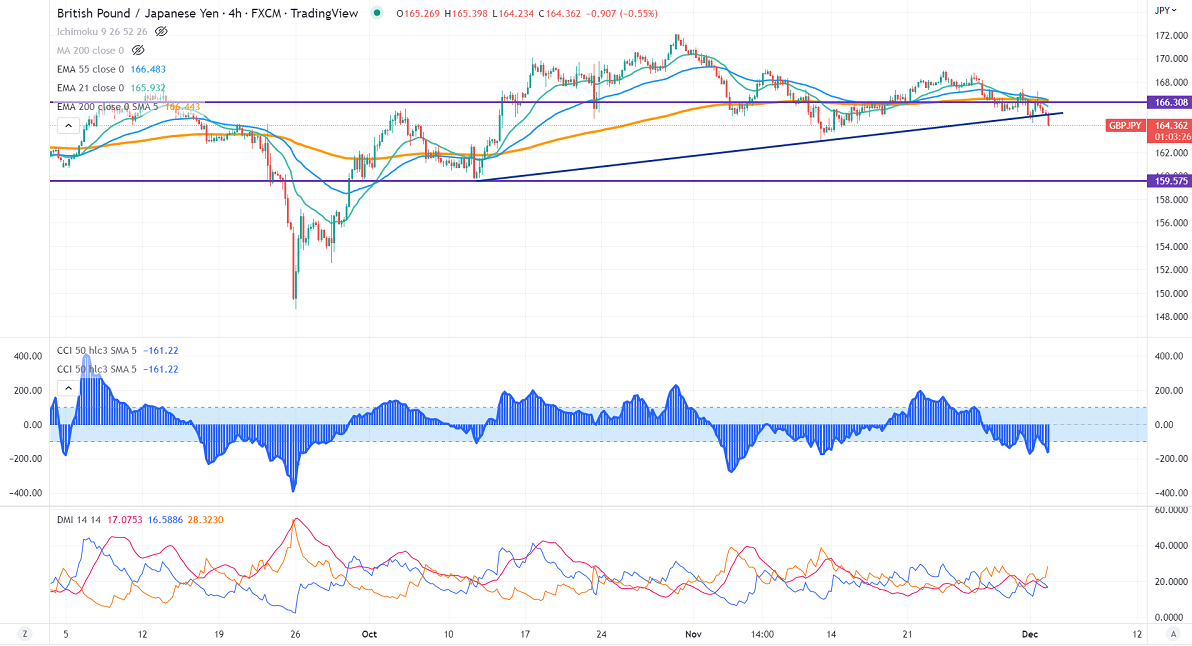

GBPJPY pared most of its gains made yesterday on the strong Yen. It hits an intraday low of 164.14 and is currently trading around 164.17.

GBPUSD- Trend- Bullish

Cable is under bearish pressure and trading below 1.2250 ahead of US NFP data. The S&P Global/CIPS manufacturing Purchasing PMI jumped to 46.5 from the previous month's 46.20. UK November HPI came at -1.4% m/m, below the estimated -0.40%. Any weekly close above 1.2315 (55-W EMA) confirms further bullishness.

USDJPY- Bearish

The pair hits a 15-week low on board-based US dollar weakness. BOJ Governor Kuroda said that the rate of global inflation is expected to exceed that of 2021, and then decline in 2023. It hits a low of 133.904 and is trading around 133.926. Any violation below 135 confirms further bearishness. Minor resistance is 137/138.25.

GBPJPY analysis-

The near-term support is around 164.50, a breach below targets 163.67/163/160. The immediate resistance is around 165.50, a jump above will take the pair to 166.30/167/167.50/169.10/170.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 165 with SL 166.20 for a TP of 160.