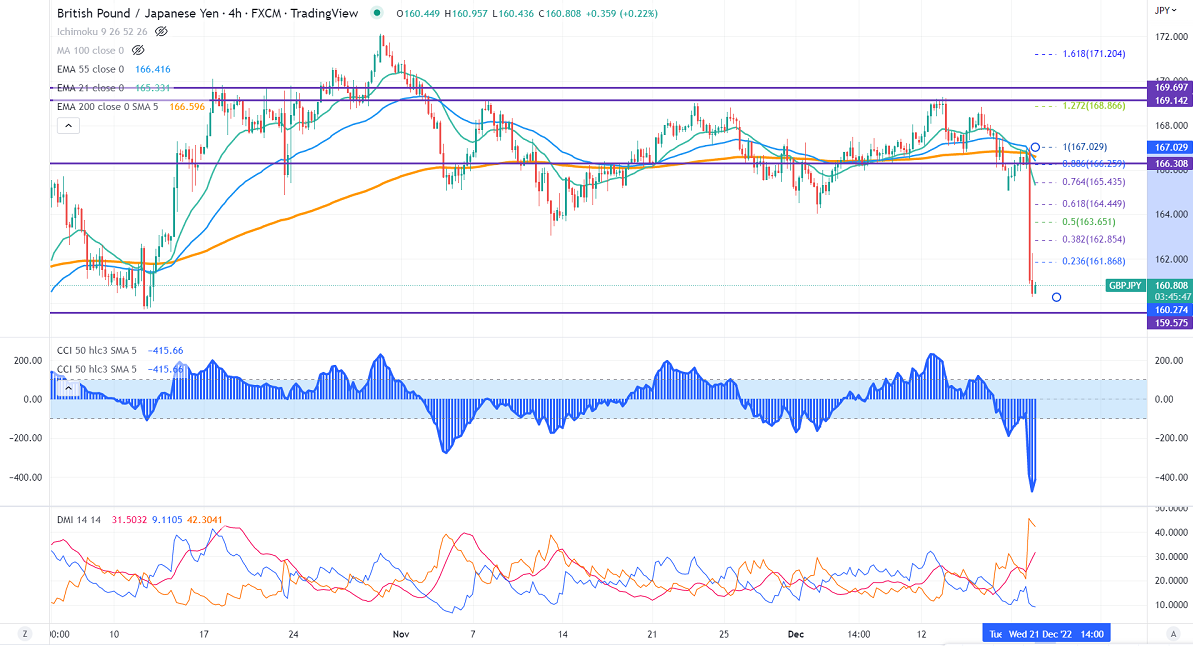

GBPJPY tumbled sharply and lost 700 pip on the strong yen. It hits an intraday low of 160.28 and is currently trading around 160.47.

GBPUSD- Trend- Bearish

The cable showed a minor pullback on board-based US dollar selling. The pound upside is limited due to weak UK economic data confirming recession in the coming quarter. Any break above 1.22250 confirms further bullishness.

USDJPY- Bearish

The pair is in bearish mode and dropped sharply to more than 500 pips after the policy tweak by BOJ. The central bank has widened the yield target range from current plus and minus 0.250% to 0.50%. Any close below 131.60 confirms a bearish continuation. Minor resistance is 133.30/134.

GBPJPY analysis-

The near-term support is around 159.70, a breach below targets 156/155. The immediate resistance is at 161, a jump above will take the pair to 161.85/163.

Indicators (4-hour chart)

CCI (50) – Bearish

ADX- Bearish

It is good to sell on rallies around 162 with SL 163 for a TP of 158.