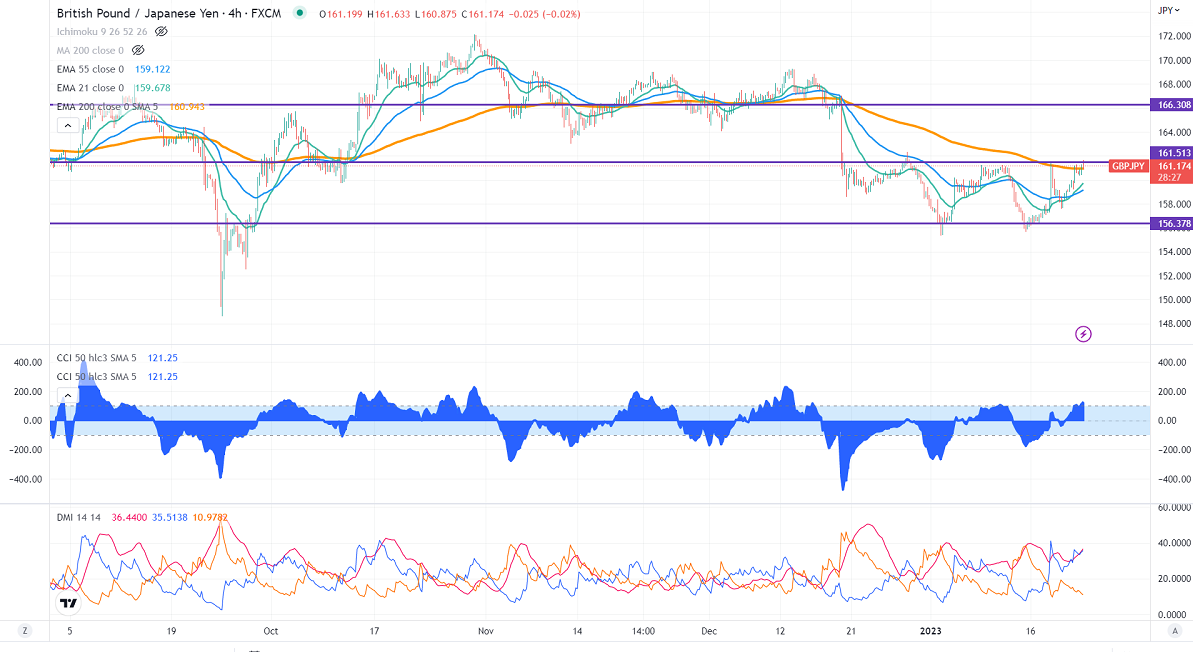

GBPJPY recovered sharply on the strong pound sterling. It hits an intraday high of 161.63 and is currently trading around 161.55

GBPUSD- Trend- Bullish

With hopes of stimulus from UK PM Rushi Sunak and board-based US dollar buying Pound sterling gained above the 1.2400 level. Downbeat UK inflation followed by a weak UK jobs report will decrease the chance of a rate hike by the BOE. Any daily close above 1.2450 will take the pair to 1.2500.

USDJPY- Bearish

The pair consolidated in a narrow range between 129.04 and 130.31 for the past two days. Major supports are 129/127.20/125.

GBPJPY analysis-

The near-term support is around 160, a breach below targets of 158.50/157.50/156. The immediate resistance is around 161.50, any violation above will take the pair to 163/164.

Indicators (4-hour chart)

CCI (50) –bullish

ADX- Bullish

It is good to buy on dips around 161 with SL around 160 for TP of 163.