GBPJPY lost its shine on the strong yen. It hits an intraday high of 162.95 and is currently trading around 162.87.

GBPUSD- Trend- Bullish

The pound sterling hits three weeks high on board based US dollar weakness. The US economy has added 311000 jobs in Feb from the previous month's 517000, above the estimate of 225000. The unemployment rate increased to 3.6% from 3.4%.

Any close above 1.2150 will pull the pair to 1.2270.

USDJPY- Bullish

The pair trades weakly as demand for safe-haven assets increased as SVB collapsed. Major support is 134/133.

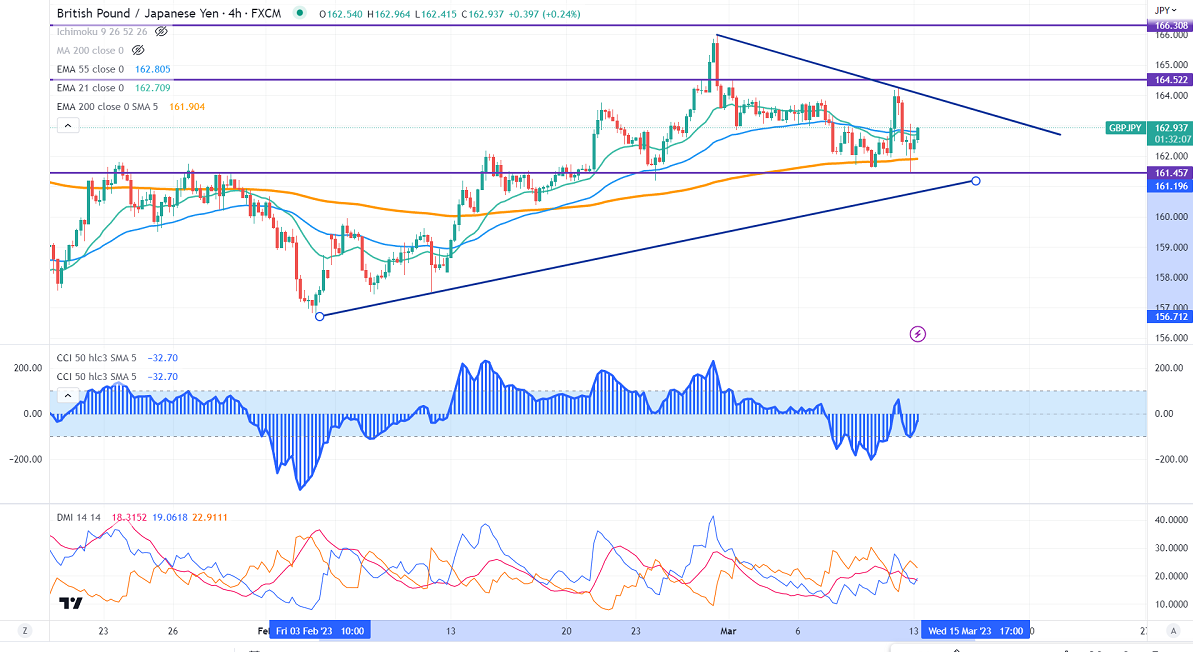

GBPJPY analysis-

The near-term support is around 162.50, a breach below the targets of 161.70/161/160. The immediate resistance is at 164, any violation above will take the pair to 165/166/167.01.

Indicators (4-hour chart)

CCI (50)- Neutral

ADX- Neutral

It is good to sell on rallies around 163.45-50 with an SL of 164.50 for a TP of 160.