GBPJPY recovered above 173.50 on strong Pound sterling. It hit an intraday high of 173.73 and is currently trading around 173.725.

GBPUSD- Trend- Bearish

The pound sterling gained more than 100 pips on upbeat market sentiment. The US House of Representatives voted yesterday to raise the debt ceiling limit to avoid default. Any break above 1.2500 confirms further bullishness.

Market eyes US ADP Non-Farm Employment and ISM manufacturing Index for further direction.

USDJPY- Bullish

The pair trading lower after hitting six months high on declining US treasury yields. Significant resistance is 141/142.

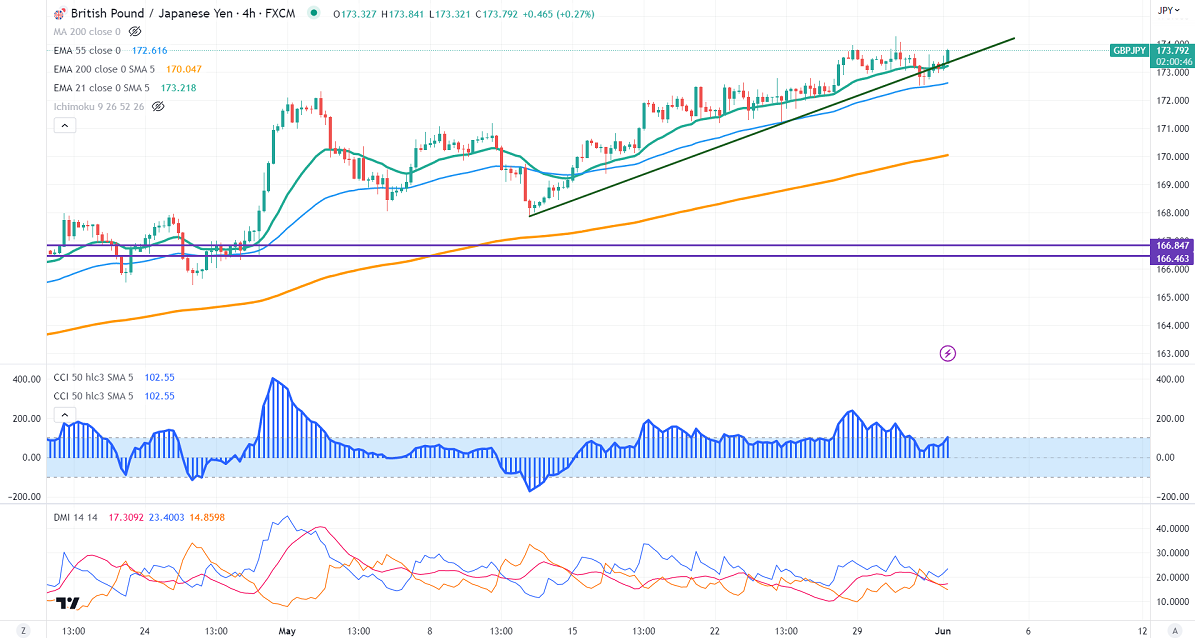

GBPJPY analysis-

The near-term support is around 172.50, a breach below targets 171.60/170/169.30. The immediate resistance is at 174, any violation above will take the pair to 175/176.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Neutral

It is good to buy on dips around 173.40-45 with SL around 172.50 for a TP of 176