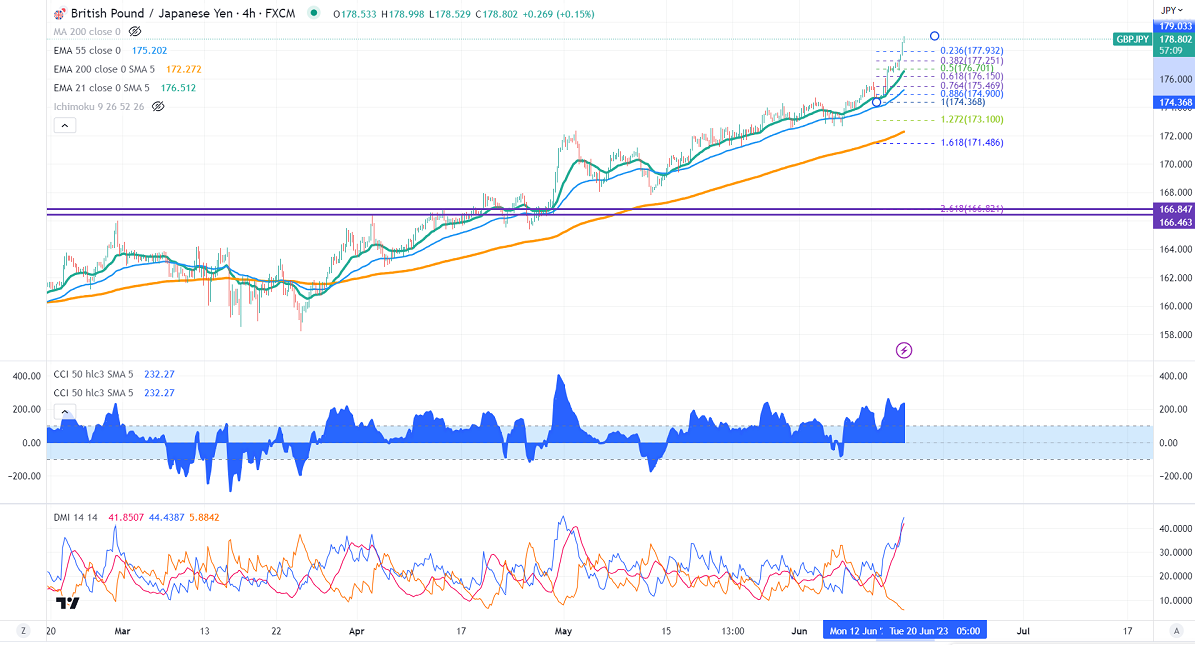

GBPJPY has continued to trade higher for the past six months on a weak yen. It hits an intraday high of 178.99 and is currently trading around 178.82.

GBPUSD- Trend- Bearish

The pound sterling climbed sharply after the hawkish Fed halt. It has kept its rates unchanged at 5-5.25%. The central bank has projected the median federal funds rate from 5.1% to 5.6% (three more 25 bpbs rate hikes in 2023). For 2024 it increased from 4.3% to 4.6%. Any break above 1.2700 confirms further bullishness.

USDJPY- Bullish

The pair hits a fresh yearly high at 141.50 in hopes of BOJ keeping rates unchanged. Significant Resistance is 143/145.

GBPJPY analysis-

The near-term support is around 177.90, a breach below targets 177.50/176.75. The immediate resistance is at 179, any violation above will take the pair to 180/182.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 178.20-25 with SL around 177.50 for a TP of 180.