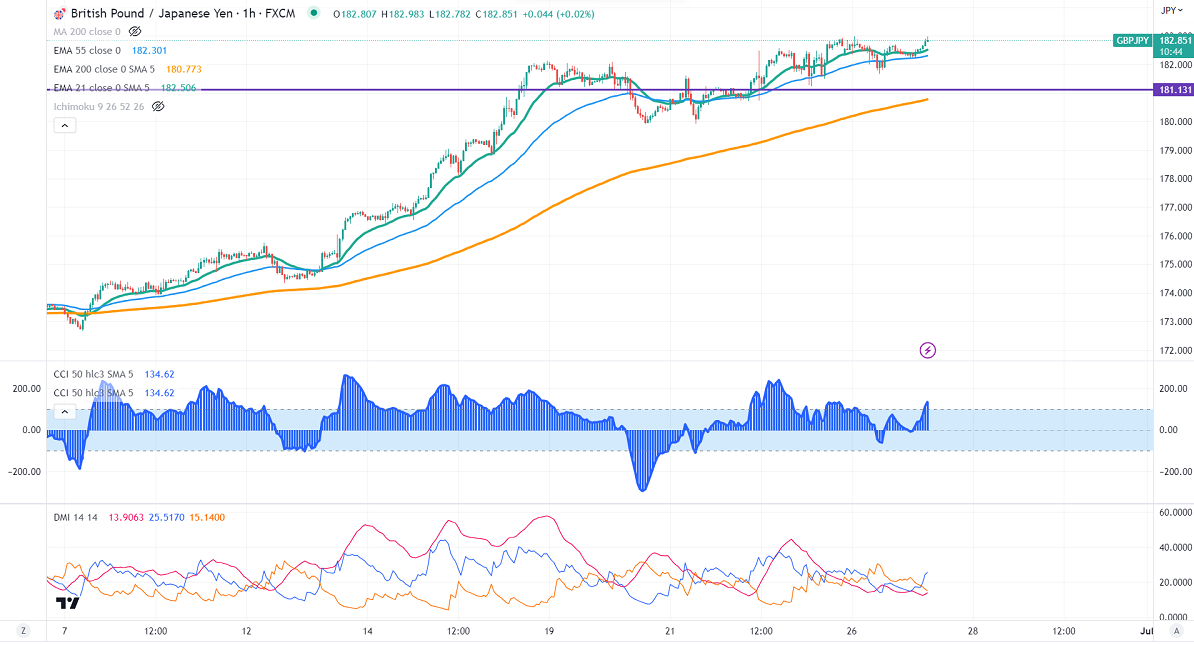

GBPJPY recovered above 182.50 on the weak yen. It hits a low of 181.68 and is currently trading around 182.89.

GBPUSD- Trend- Bullish

The pound sterling edges towards 1.2750 on upbeat market sentiment. The policy divergence between US Fed and BOE supports the pound sterling at lower levels. Any break above 1.2750 confirms intraday bullishness.

USDJPY- Bullish

The pair trades higher as BOJ remains dovish in order to tackle inflation. Significant Resistance is 144/145.

GBPJPY analysis-

The near-term support is around 182.50, a breach below targets 181.65/181. The immediate resistance is at 183, any violation above will take the pair to 184/185.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 182 with SL around 181 for a TP of 185.