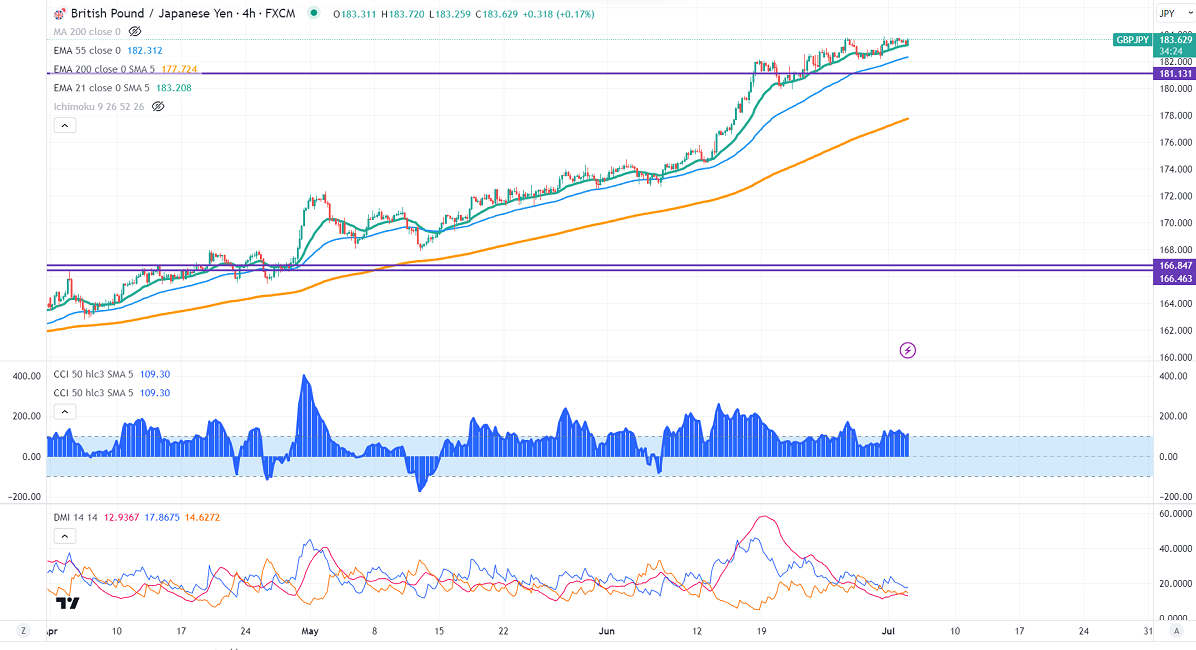

GBPJPY is trading flat between 183.874 and 182.92 for the past three days. It hits a low of 183.23 and is currently trading around 183.67.

GBPUSD- Trend- Bullish

The pound sterling recovered above 1.2700 on weak US ISM manufacturing PMI. US ISM manufacturing PMI declined in June to 46, compared to a forecast of 47.20 expected. Any break above 1.2750 confirms intraday bullishness.

USDJPY- Bullish

The pair showed a minor profit booking after hitting a fresh seven-month high on BOJ intervention fears. Significant Resistance is 145.250/146.

GBPJPY analysis-

The near-term support is around 182.90, a breach below targets 182/181.65/181. The immediate resistance is at 184, any violation above will take the pair to 185/186.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 183 with SL around 182 for a TP of 185.