GBPJPY is trading weak for the third consecutive day on weak Pound sterling. It hit a low of 180.40 and is currently trading around 181.11.

GBPUSD- Trend- Bearish

The pound sterling pared some of its gains despite mixed US Non-farm payroll data. The US economy has added 187000 jobs in Jul, below the forecast of 205k. The unemployment rate dropped to 3.4% from 3.6% the previous month. Average hourly earnings m/m increased to 0.40% vs an estimate of 0.30%. Any break above 1.2750 confirms further bullishness.

USDJPY- Neutral

The pair showed a minor decline despite the hawkish BOJ. The significant resistance is 143/145.

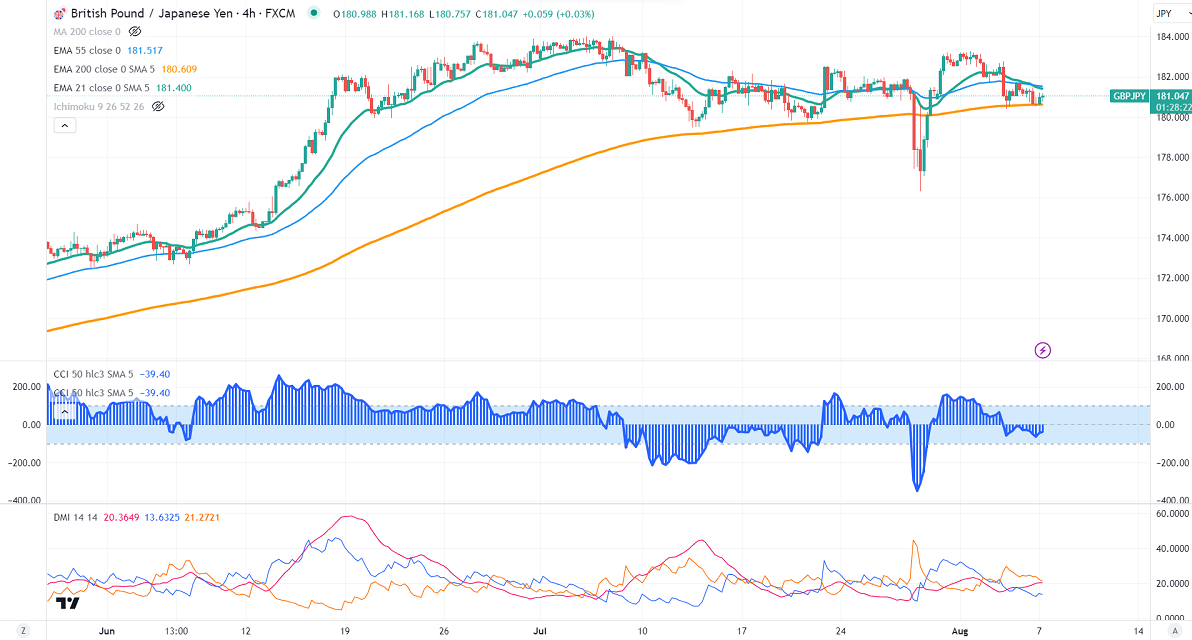

GBPJPY analysis-

The near-term support is around 180.40, a breach below the target of 180/178.80/176.50. The immediate resistance is at 181.50, any violation above will take the pair to 182.50/183.25/184.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to stay away.