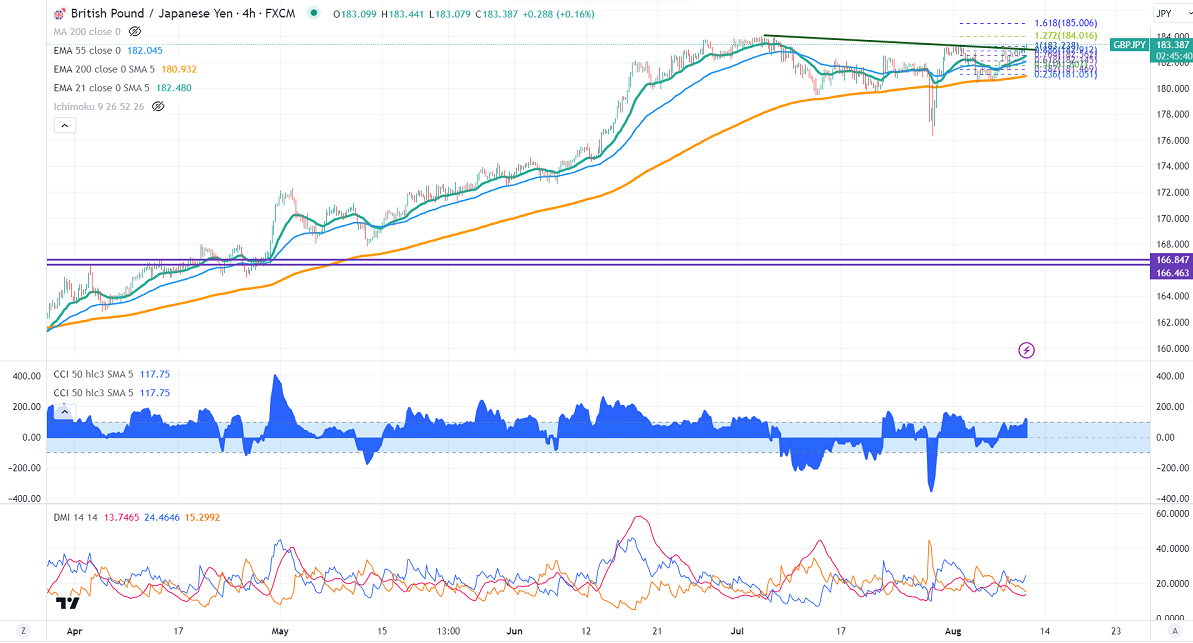

GBPJPY trades above 183 after a long consolidation. It hit a high of 183.201 yesterday and is currently trading around 183.18.

GBPUSD- Trend- Bearish

The pound sterling trades slightly lower ahead of US CPI data. Inflation is expected to show a minor uptick last month. Any drastic surge in US CPI drags the pair further down. Any break below 1.2680 confirms further bearishness.

USDJPY- Neutral

The pair hit a fresh monthly high ahead of US CPI data. The significant resistance is 145/146.

GBPJPY analysis-

The near-term support is around 182.50, a breach below the 181.75/181/180.40 target. The immediate resistance is at 184, any violation above will take the pair to 185/186.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 183 with SL around 182.36 for a TP of 186.