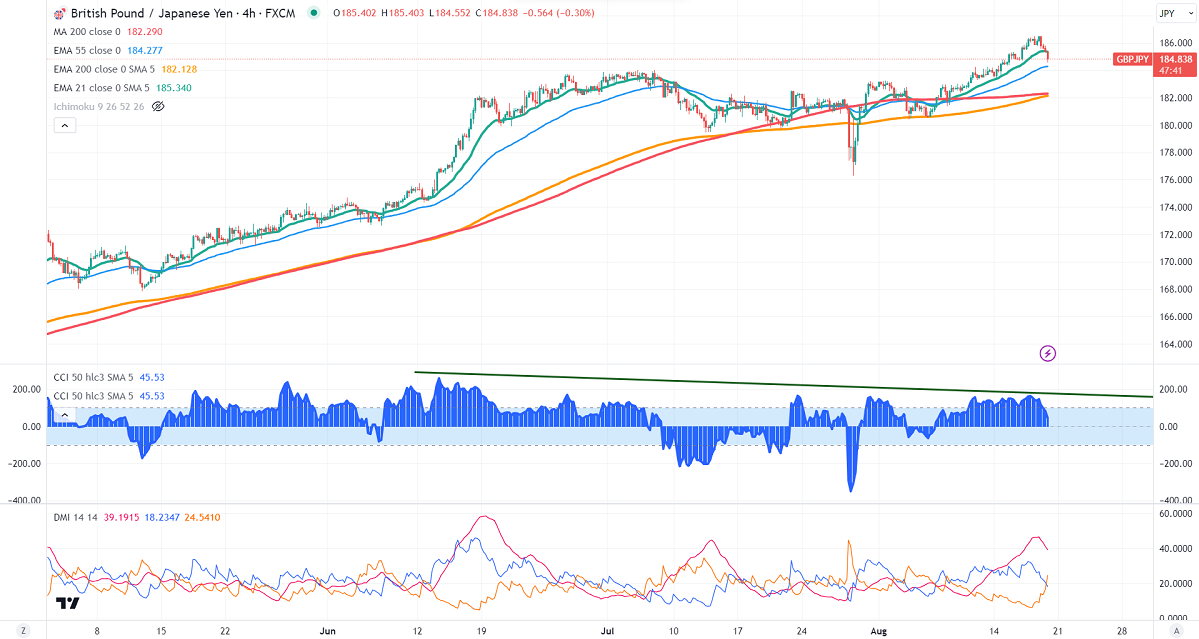

Bearish divergence - CCI (50)

GBPJPY pared some of its gains after a heavy surge of more than 800 pips from a minor bottom 176. It hit a high of 184.55 yesterday and is currently trading around 184.602.

GBPUSD- Trend- Bearish

The pound sterling showed a minor sell-off after weak UK retail sales. It came in at -1.20% m/m in Jul, compared to a forecast of -0.50%. The Core retail sales dropped to 1.40% MoM vs -0.70% expected. Any break below 1.2700 confirms further bearishness.

USDJPY- Neutral

The pair showed a minor profit booking as US yields retreated. The significant resistance is 146/147.

GBPJPY analysis-

The near-term resistance is around 185.60, a breach above targets 186.50/187/188.50. The immediate support is at 184.38, any violation below will drag the pair to 183.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- neutral

It is good to sell on rallies around 185.45-50 with SL around 186.50 for a TP of 180.60.