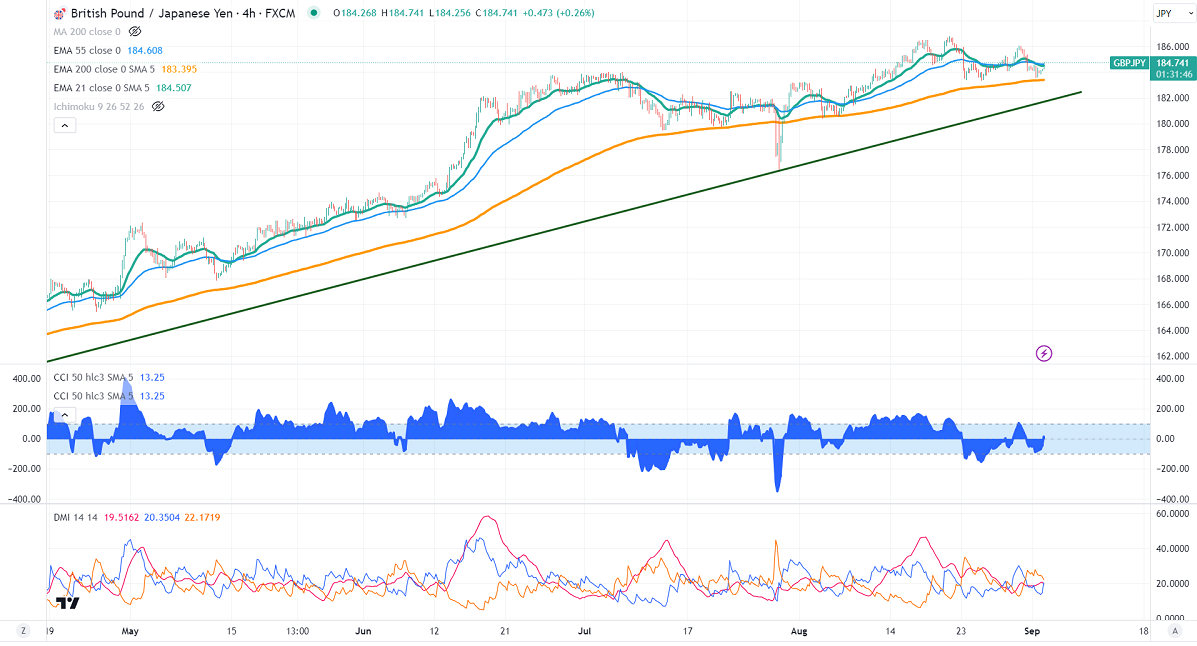

GBPJPY showed a minor pullback on the weak yen. It hit a high of 184.647 at the time of writing and is currently trading around 184.75.

GBPUSD- Trend- Bearish

After mixed US jobs data, the pound sterling pared most of its gains on Friday. The US economy has added 187000 in August, compared to a forecast of 170000. The unemployment rate rose to 3.8% vs. the forecast of 3.6%. Any break above 1.2660 confirms further bullishness.

USDJPY- Neutral

The pair trades jumped more than 100 pips as the US treasury yield jumped more than 3%. The significant resistance is 146.50/147.50.

GBPJPY analysis-

The near-term resistance is around 185, a breach above targets 186/186.50/187/188.50. The immediate support is at 184, any violation below will drag the pair to 183/182

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- neutral

It is good to buy on dips around 183.45-50 with SL around 183.35 for the TP of 186.65.