Intraday Bias -Bearish

GBPJPY recovered during Asian session after a massive sell-off. It hits a low of 186.42 yesterday and is currently trading around 187.64.

Yen was the best performer the previous week due to BOJ policy divergence and easing bond yields.

Technicals-

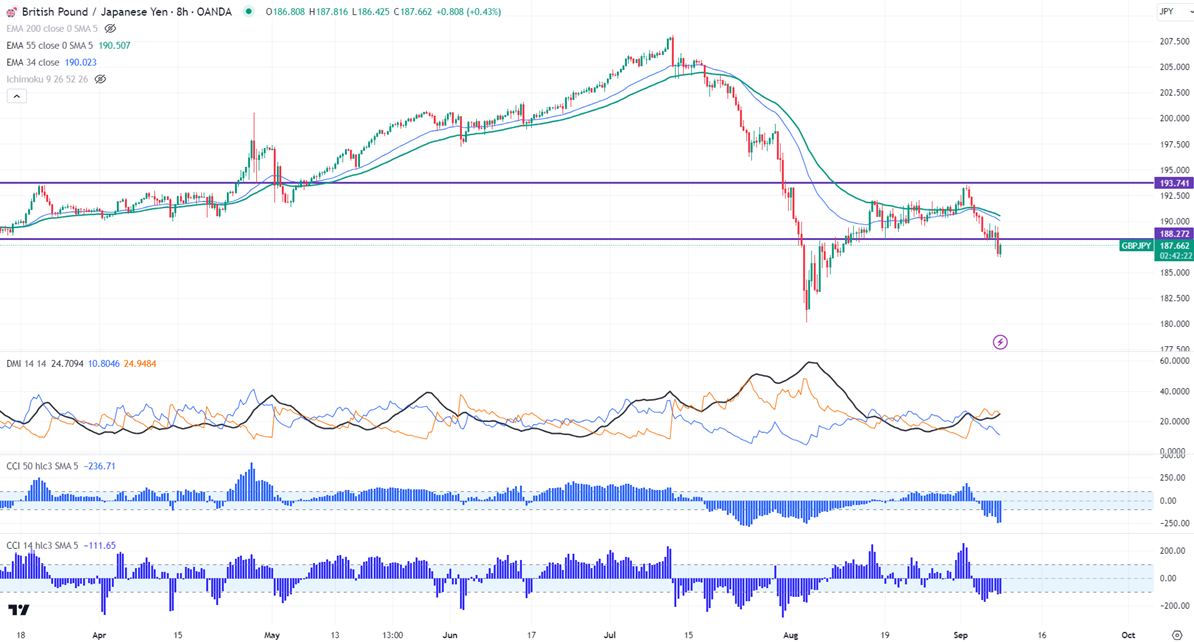

The pair trades below short-term 34,55 EMA and long-term 200 EMA in the 8-hour chart.

The near-term resistance is around 188.07 (23.6% fib) , a breach above targets 188.37/189/189.53.Major trend continuation only above 190. The immediate support is at 186.40, any violation below will drag the pair to 185.86 (1.618% fib)/183.58.

Indicator (8-hour chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index - Bearish. All indicators confirm a bearish trend.

It is good to sell on rallies around 188.38-40 with SL around 189.50 for a TP of 183.