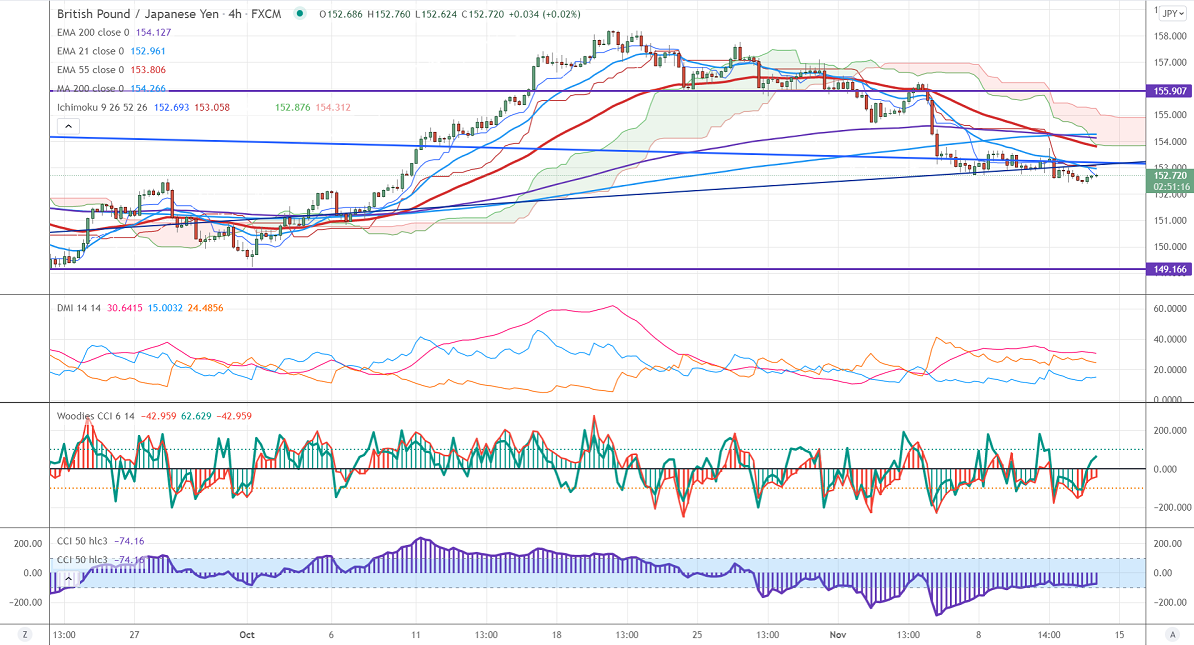

Major Intraday resistance -153.75

Intraday support- 152.50

GBPJPY continues to trade lower on the weak Pound sterling. GBP hits 11-month low against US dollar board-based US dollar buying and Brexit risks. Any breach below 1.3350 will drag the pound to 1.3150. The intraday trend is bearish as long as resistance 153.80 holds. It hits an intraday low of 152.57 and is currently trading around 152.84.

USDJPY- Analysis

The pair is holding above 114 levels on board-based US dollar buying. Any jump above monthly high 114.45 targets 115/116.

CCI Analysis-

The CCI (50) and Woodies CCI are holding below zero level in the 4-hour chart. This confirms the weak trend. Bearish trend confirmed.

Technical:

The immediate resistance is around 153.80, any break above targets 154.55/155. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 152.50. Any indicative violation below targets 152.18/151.60.

Indicator (4-Hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 153.25 with SL around 153.80 for a TP of 151.