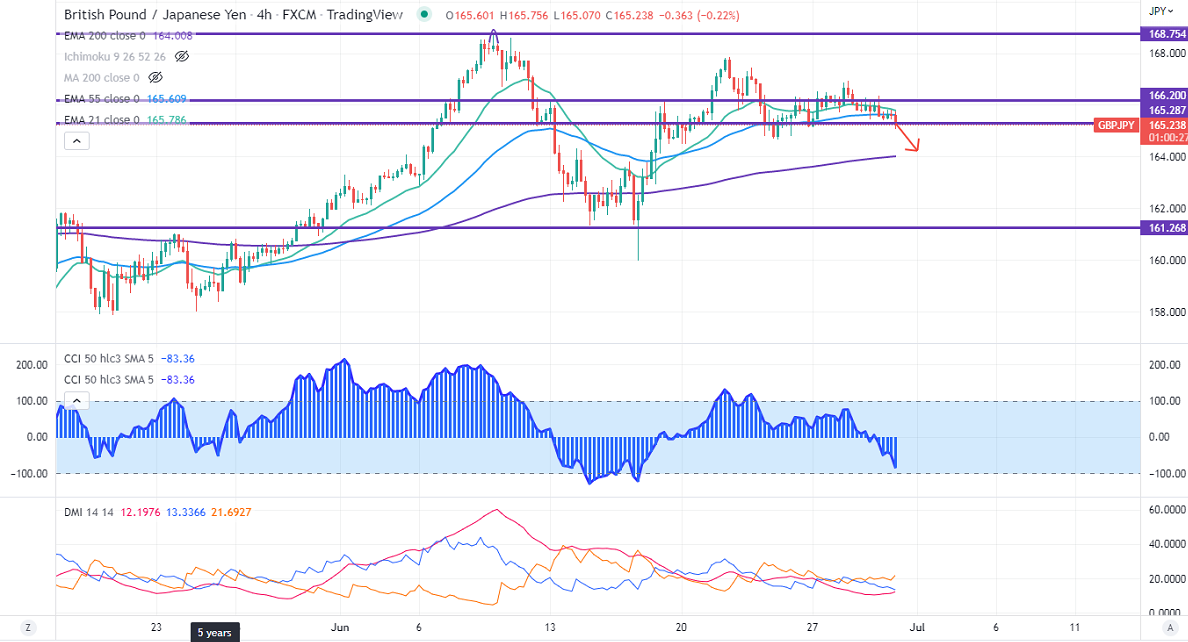

GBPJPY trades lower for a third consecutive day on the weak Pound sterling. It has pared some of its gains made in the Asian session after UK economic data. It has posted a record current account surplus at 51.7 billion pounds compared to 39.7 billion pounds. Any breach below 1.2100 confirms a bearish continuation. Technically in the 4-hour chart, the pair is holding below 21-EMA, above 55 EMA, and long-term 200 EMA (163.99). Any break below 165 will drag the pair down to 164.60/163. GBPJPY hits an intraday high of 165.75 and is currently trading around 166.475.

The near-term resistance is around 165.75, any breach above targets 166.35/167/167.85/168.75.

Indicators (4-hour chart)

CCI (50) - Bearish

ADX- Bearish

It is good to sell on rallies around 165.38-40 with SL around 166.35 for TP of 164.