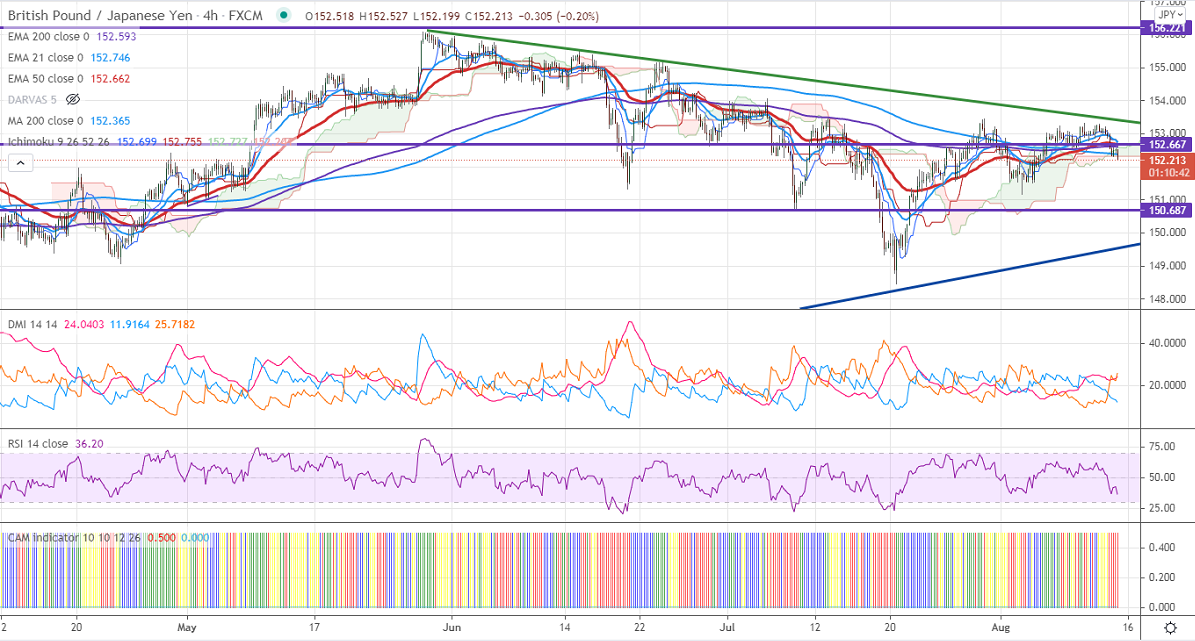

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.80

Kijun-Sen- 152.81

Previous week high – 153.45

GBPJPY has shown a massive sell-off after a pullback to 153.30. The slight weakness in Pound sterling despite upbeat UK GDP. GBPUSD is hovering near 1.3800 level, any breach below 1.3760 will drag the pair down to 1.3700.USDJPY is trading low for the past two days on surging US Treasury yields. The intraday trend of GBPJPY is bearish as long as resistance 153.25 holds.

Technical:

The pair's immediate resistance is around 152.80, any jump above targets 153.30/153.50/154/155.05/156. Significant bullish continuation if it breaks 156.60. On the lower side, near-term support is around 152. Any indicative violation below targets 151/150.65/150.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and above Tenken-Sen.

Indicator (4-Hour chart)

CAM indicator-Bearish

Directional movement index –Bearish

It is good to sell on rallies around 152.55-60 with SL around 153.24 for a TP of 150.65.