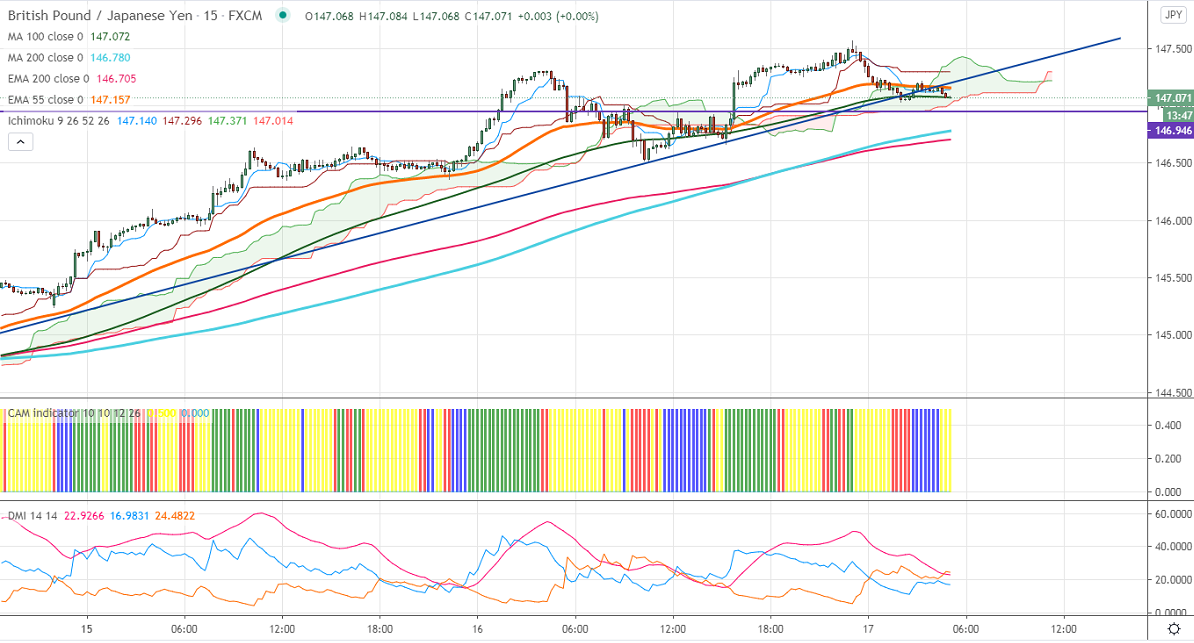

Ichimoku Analysis (15 min Chart)

Tenken-Sen- 147.14

Kijun-Sen- 147.29

GBPJPY has halted its two months of the bullish trend and lost more than 40 pips. The pair was one the best performers in past one month on broad-based yen weakness. USDJPY continues to trade higher and holding above 200- day MA, a jump till 106.40 likely. GBPUSD hits 34 months high on the UK vaccine rollout and a decline in several new coronavirus cases. Markets eye UK CPI data for further direction.

Technical:

The pair's significant resistance at 147.95, any convincing break above confirms bullish continuation. A jump till 150/151.20 possible. On the lower side, near-term support is around 146.70 (200- 15 min MA). An indicative break below will drag the pair down till 146/145.80/145/144. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (15 min chart)

CAM indicator –Neutral

Directional movement index – neutral

It is good to sell below 146.69 with SL around 147.21 for the TP of 145.