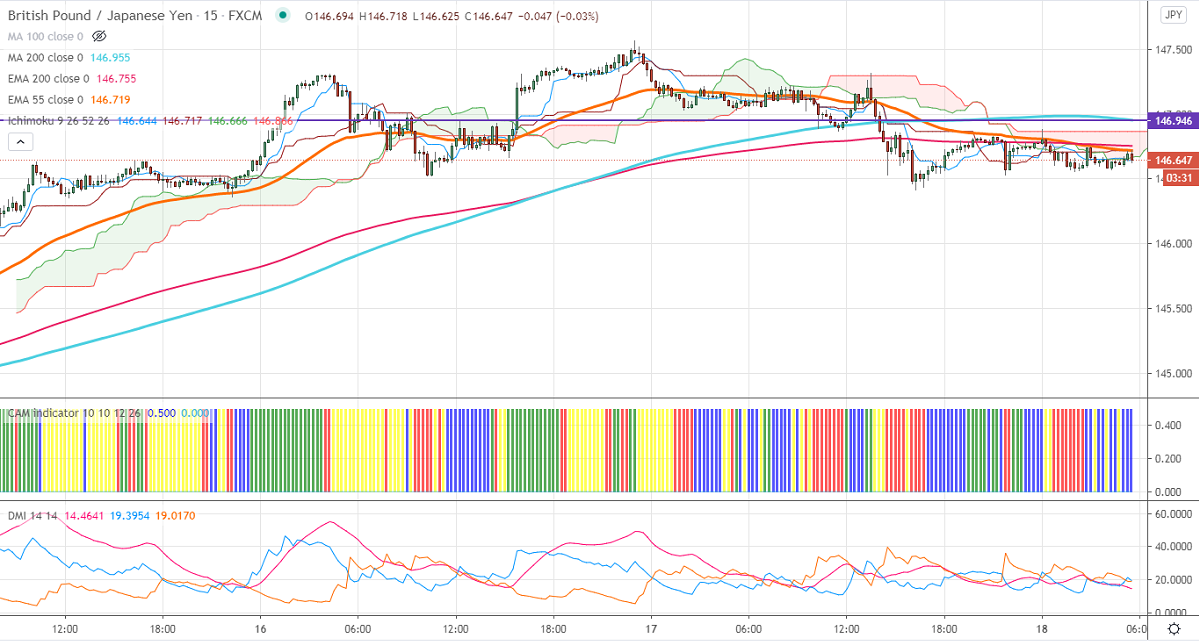

Ichimoku Analysis (15 min Chart)

Tenken-Sen- 146.64

Kijun-Sen- 146.71

GBPJPY lost more than 100 pips on Pound sterling weakness. GBPUSD declined sharply from a multiyear year high of 1.3950 on broad-based US dollar buying. UK inflation rose by 0.70% in Jan better than forecast 0.6%. It remains well below the Bank of England target of 2%. USDJPY is consolidating after a five-month high as US yield rose. The intraday trend of GBPJPY is weak as long as 147 holds.

Technical:

The pair's significant resistance at 147.95, any convincing break above confirms bullish continuation. A jump till 150/151.20 possible. On the lower side, near-term support is around 146.40. An indicative break below will drag the pair down till 146/145.80/145/144. Significant trend reversal only below 144. A violation below will drag the pair to 142.80.

Indicator (15 min chart)

CAM indicator –Neutral

Directional movement index – neutral

It is good to sell on rallies around 146.75-80 with SL around 147.50 for the TP of 145.